Cyber attacks used to sound like an IT problem. Today they feel more like a balance sheet problem.

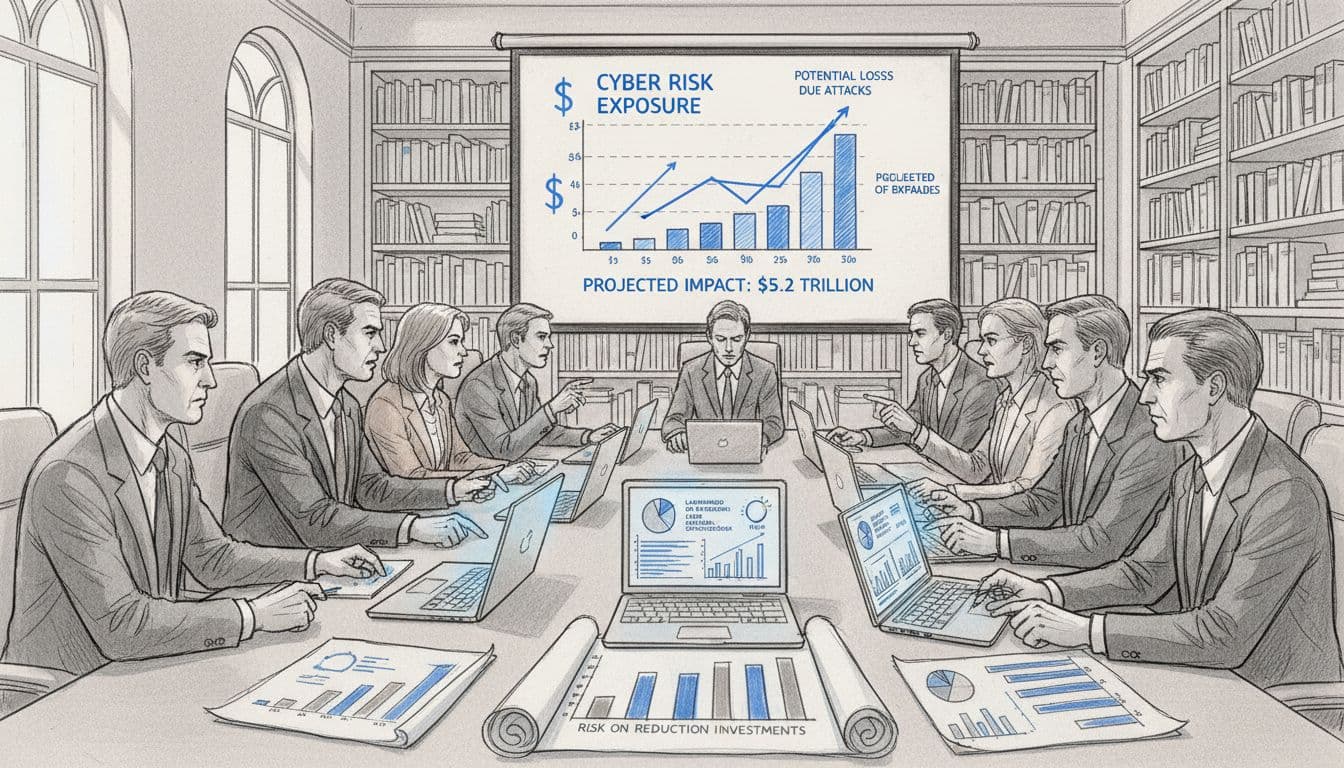

At its core, cyber risk quantification means turning cyber risk into dollars. Instead of hearing “our ransomware risk is high,” you see “we face an expected 20 million dollar loss each year from ransomware.” That shift in communicating risk changes the conversation from fear and headlines to money and tradeoffs.

This article is for business leaders and Board members, directors, CEOs, and non-technical executives who want clearer answers to simple questions. What should we fund, what can wait, and where do we get the most reduction in risk per dollar?

The goal is not to argue for a bigger security budget. The goal is to plug cyber risk quantification into your normal risk management and capital allocation process, so you can compare it to every other use of cash and invest where it truly matters most.

What Is Cyber Risk Quantification and Why Boards Should Treat It Like Any Other Financial Metric

Cyber risk quantification means expressing cyber threats in financial terms. It turns technical risk into a range of possible losses, with probabilities, in dollars. Often abbreviated as CRQ, cyber risk quantification works the same way.

Think about how you treat storm damage on a factory or fire risk in a warehouse. You do not measure it in colors or vague labels. You measure it as expected financial loss, then decide how much to spend on insurance, controls, backups, and cybersecurity insurance.

Cyber risk quantification can be treated the same way.

You already use this approach in other areas:

- ROI on projects: How many dollars in return for each dollar invested.

- Insurance risk: What is the chance of a loss, and how large might it be.

- Credit risk: What happens if a customer fails to pay, and how big is that hole.

Cyber risk quantification applies the same thinking to attacks, data loss, and outages. It asks simple questions. How often might an event happen. If it does, how much could it cost us in business interruption, recovery, legal, and reputational impact.

Once you have the answers in money terms, cyber risk can sit beside every other financial risk on your dashboard. That lets boards weigh it using the same discipline used for capital projects, acquisitions, or new products.

From technical risk scores to dollar-based cyber risk

For many years, security teams came to the board with qualitative assessments like red, yellow, and green charts or NIST-based scores like “our maturity is 3.2 out of 5.” Those signals are hard to use in a capital discussion.

Dollar-based risk changes that.

At a high level, breach risk is:

Likelihood of an event x Severity of financial impact if it happens

Both pieces are expressed in money terms. Likelihood might be “a 20 percent chance of a major ransomware incident each year.” Magnitude of impact might be “a 60 million dollar loss if it hits.”

Multiply them, and you get an expected loss. That number is not perfect, but it is useful. It lets you say, “Our expected annual ransomware loss is 12 million dollars.”

Now you can compare that to other business risks, in the same currency. You can ask what it would cost to reduce that number, just as you would for plant safety or supply chain risk.

How cyber risk quantification changes board conversations

Once risks are quantified, the tone in the boardroom shifts.

Instead of “We might get hacked, and it would be terrible,” you start to hear:

“We face an expected 20 million dollar annual loss from ransomware, and a 4 million dollar investment in backups and access controls would cut that in half.”

That is a tradeoff, not a scare tactic.

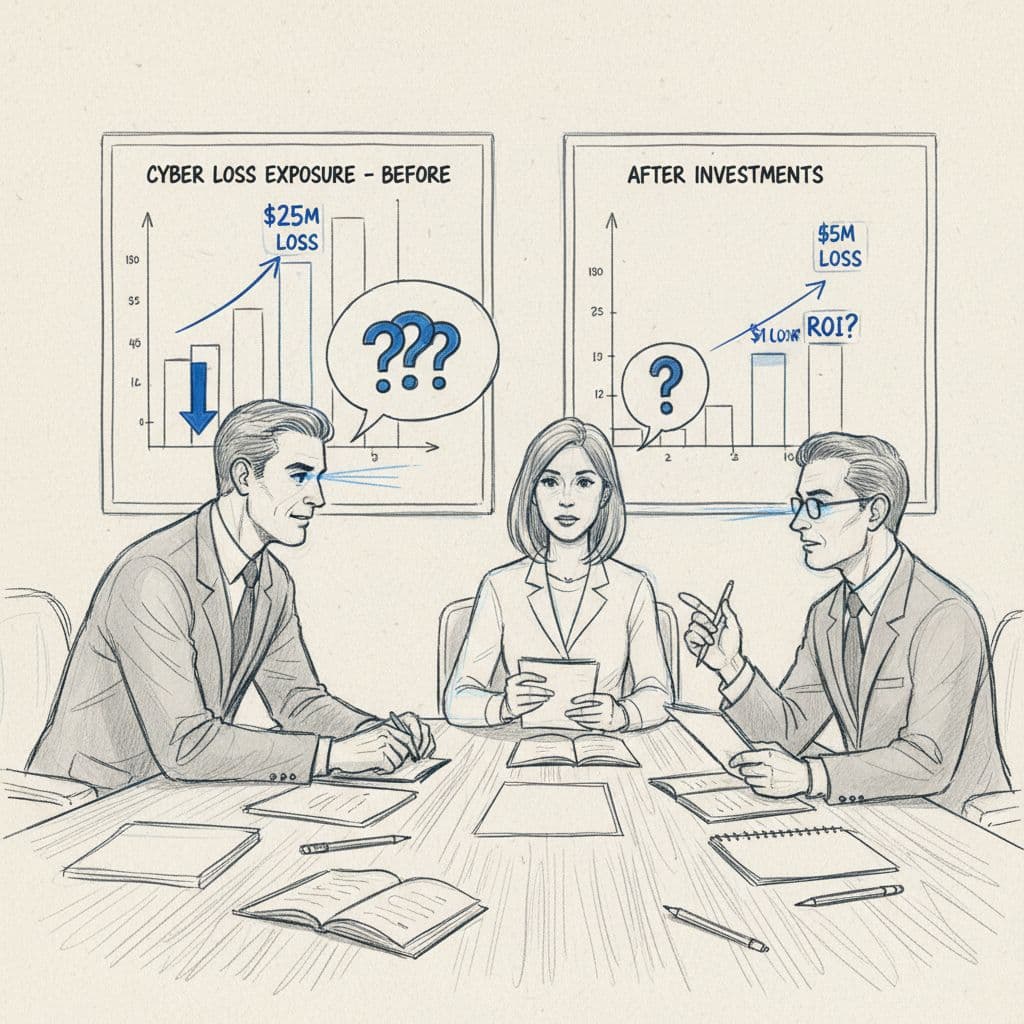

Boards can ask sharper questions about return on security investment. For example, “If we approve this 4 million dollar spend, show us the expected loss before and after, and the payback period.”

CISOs also gain a clearer way to justify or right-size budgets. If a program does not move the loss numbers, it is hard to defend. If it reduces expected loss by tens of millions, it becomes easier to fund.

Example: A retail group sees a 15 million dollar expected annual loss from payment card theft. The security team proposes:

- 3 million dollars to upgrade fraud detection, and

- 1 million dollars to harden the payment application.

Together, these reduce expected loss to 6 million dollars. The board can now see a 9 million dollar reduction in expected loss for a 4 million dollar spend, and debate that as a financial decision.

Modern methods boards will hear about (FAIR Model, simulations, and scenarios)

Behind these numbers sit structured methods. Three common ones you might hear are:

- FAIR Model (Factor Analysis of Information Risk): A framework that breaks cyber events into clear factors, such as frequency and magnitude.

- Monte Carlo simulations: Many repeated “what if” runs on a computer to see a range of possible loss outcomes.

- Scenario analysis: Narrative scenarios like “major ransomware on our core plant” that are then quantified. The FAIR Model supports this kind of structured risk modeling.

Boards do not need to be experts in any of these. What matters is that the numbers are data-driven, based on repeatable risk modeling, not guesswork on a slide.

A good question for any CEO or director is, “How did we produce these estimates, what data feeds them, and how often do we update them as our environment and threat picture change.”

Using Cyber Risk Quantification To Make Better Capital Allocation Decisions

Once you have cyber risk quantification (CRQ) in dollar terms, you can plug it into existing risk management and capital planning. Cyber stops being a separate “security problem” and becomes part of your portfolio of bets.

You can compare security projects directly to other uses of capital: new plants, new features, debt reduction, or share buybacks.

Turn cyber risk quantification numbers into a clear loss exposure baseline

First, ask for a simple baseline view:

“What is our total Annualized Loss Expectancy for financial loss from cyber events across our top threats, including our overall risk exposure.”

That might look like, “We have an expected 25 million dollar annual cyber loss from ransomware, business email compromise, and third-party outages, representing our key risk exposure.”

This is your starting point. It belongs on the same page as credit risk and operational risk.

Strong dashboards also break exposure down by:

- Major business unit or region

- Critical processes such as payments, customer onboarding, or plant operations

You do not need to see every technical system. You need to see how cyber risk touches revenue, margin, and critical services.

From there, any investment conversation should begin with, “How does this spend change our 25 million dollar number, and where does the change show up.”

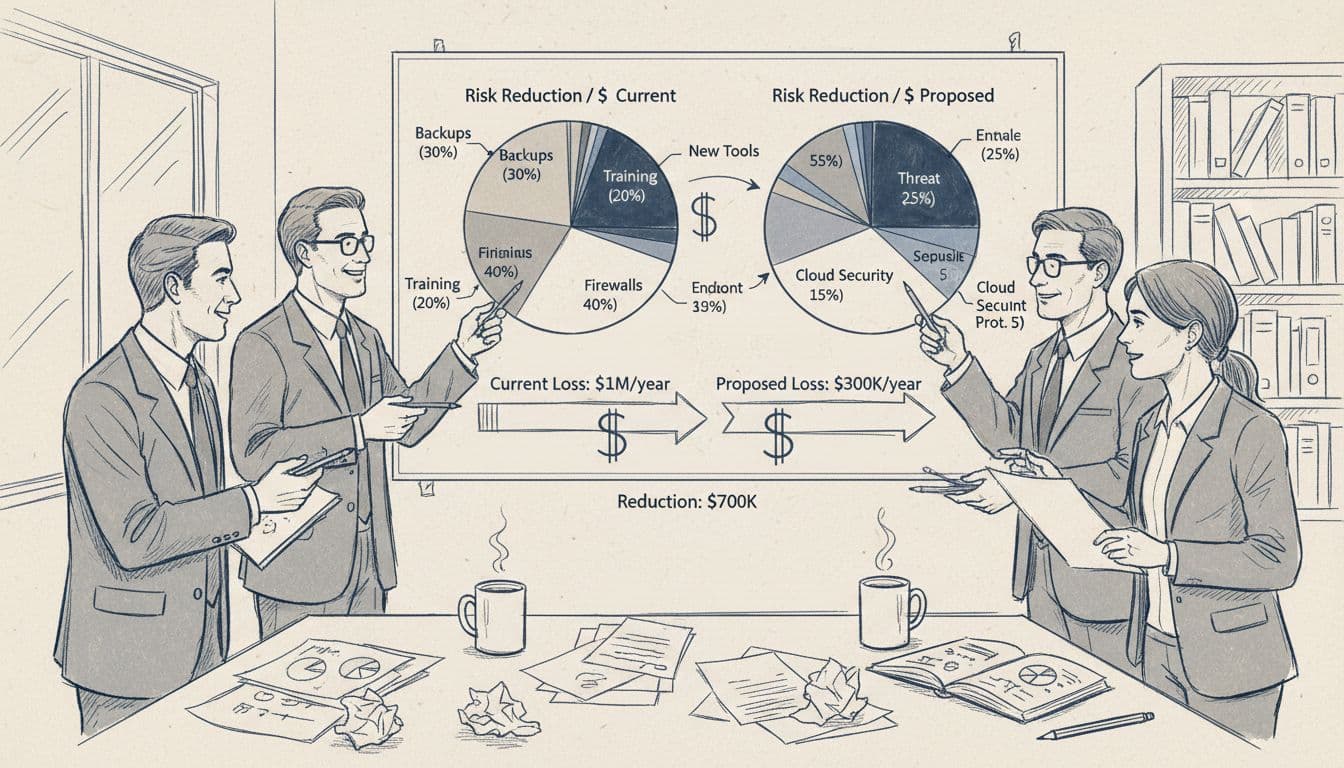

Compare security investments by risk reduced per dollar spent

Security projects, including mitigation strategies, should compete for capital like any other project.

For each proposed initiative, ask two core questions:

- How much expected loss does this reduce.

- What is the ratio of dollars invested to dollars of risk reduced.

Simple example:

- Today, expected ransomware loss is 10 million dollars per year.

- A 1 million dollar investment in improved backups and recovery drills to address vulnerabilities reduces it to 2 million dollars.

That is an 8 million dollar reduction in expected financial loss for a 1 million dollar spend. The ratio is 8 to 1.

You can now compare that to another project, such as a 2 million dollar tool that cuts data theft loss by 3 million dollars. In a side by side view, the backup project might rank higher, even if the new tool seems more advanced.

This framing also helps in tradeoff conversations. You might delay a lower value IT project to fund a high impact control, because the reduction in expected loss is simply more attractive.

Prioritize across business units, critical assets, and third-party risk

Not all assets deserve the same level of protection. Technology Risk quantification helps answer “Where first” through effective prioritization.

You can compare:

- A revenue generating payments platform

- A safety control system in a plant

- A low risk internal HR tool

If the payments platform shows a 20 million dollar potential impact and the HR tool shows 500 thousand dollars, you have clear guidance. Upgrading protections around payments should come first through smart attack surface management.

The same logic applies to vendors and supply chain partners such as third-party providers. A single cloud provider or logistics firm might represent a 15 million dollar outage risk. In that case, funding better contracts, security controls, and monitoring around that vendor is part of smart capital allocation, not a side topic.

Align cyber investments with strategy, risk appetite, and regulations

Cyber numbers should line up with your strategy and risk appetite, not sit apart from them.

For example, a company that wants to grow digital revenue may accept more operational risk. It might not accept more customer data loss risk, because that would damage trust and trigger regulators.

Boards can set clear thresholds in dollar terms, such as:

- “We are comfortable with up to 10 million dollars in expected annual cyber loss overall.”

- “We are not comfortable with more than 2 million dollars of expected loss tied to customer data exposure.”

Then ask, “Do our current and planned cyber investments keep us inside these bounds, and are we meeting regulatory expectations in our sector, including NIST guidelines, at the same time.”

This connects cyber spend to what you are trying to achieve as a business, not just to fear of fines.

Set expectations for ongoing reporting and course correction

Capital allocation is never a one-time event. Neither is cyber.

Boards and CEOs should expect regular updates, often quarterly, on quantified cyber risk. These reports should highlight:

- Change in total expected loss since last period

- Risk reduction per dollar invested in major programs

- Time to resolve or mitigate high loss scenarios

If a 5 million dollar program only reduced expected loss by 1 million dollars, that is a signal to adjust. If a lower cost initiative cut loss by far more than planned, that is a sign to double down.

A clear view of “before and after” lets leaders shift funding away from low impact efforts and toward actions that move the loss numbers in a meaningful way.

Practical Questions Boards and CEOs Should Ask To Turn Cyber Risk Quantification Into Action

CEO, CISO, and CFO aligning on cyber risk numbers and actions. Image created with AI.

You do not need to be technical to lead on cyber risk quantification. Business leaders and Boards just need the right questions.

Questions to test the quality of your cyber risk numbers

Use questions like these to probe how solid the numbers are in your cyber risk quantification (CRQ) and risk assessment:

- What data goes into our cyber risk quantification and risk modeling, and where does it come from.

- How often do we refresh the inputs and the loss estimates.

- What are the top five assumptions in the model, and how sensitive are our results if those change.

- Where do we have the least confidence in our numbers, and how are we improving that.

Look for transparency and consistency. You are not looking for perfect precision, you are looking for data-driven insights you can trust over time.

Questions to link cyber risk quantification to the budget

Tie cyber numbers directly to capital allocation, engaging CISOs along the way:

- For each major cyber program in our budget, how much expected loss does it reduce.

- Which planned investments give us the highest risk reduction per dollar spent.

- If we had to cut 20 percent from the security budget, what would we stop or delay, and what new expected financial loss, in dollars, would that create.

- If we had an extra 10 percent to invest, where would we put it for prioritization to buy down the most risk with security controls.

These questions keep every security spend tied to a financial outcome.

Questions to align cyber risk decisions with business priorities

Bring it back to strategy and growth:

- Which strategic initiatives, such as new digital products, AI, or cloud migrations, change our cyber loss exposure the most from a cyber event.

- Which critical customer or safety processes carry the highest quantified cyber risk from vulnerabilities today.

- Are our cyber investments keeping pace with those changes, or are they still focused on last year’s priorities.

- Where does third-party or supply chain risk create the largest potential loss for our strategy.

This script gives you a repeatable way to drive the conversation toward business outcomes and communicating risk, not only technical detail.

Conclusion

When boards and CEOs quantify cyber risk, cyber stops being a fuzzy technical topic and starts to look like what it is, a financial risk that can be priced, reduced, and managed.

You do not need to understand the math behind every model. You do need to demand clear, dollar-based views of cyber risk exposure and simple explanations of risk reduction per dollar spent.

If you want support turning these ideas into a practical board narrative, you can schedule a conversation with experts at CTO Input. To go deeper on CRQ and related technology and governance topics, explore more insights on the CTO Input Blog.