Most boards do not care how elegant your architecture is or how clever the AI model might be. What they want is a simple, believable way to see where each dollar goes, and why. That is the heart of The Investment Priority Framework Boards Actually Use.

You feel the squeeze every budget cycle. Too many projects, not enough cash, louder questions about AI, cybersecurity, and tired core systems. Your IT lead brings a 40‑page roadmap, your board has a 40‑minute agenda slot, and your lenders want proof you are not sleepwalking into a cyber incident.

This article gives you a simple, reusable framework that fits on one page. You can take it to your next board or lender meeting, use it to organize every tech and cyber ask, and finally have a conversation about tradeoffs in clear business terms.

What Boards Really Want From An Investment Priority Framework

Photo by Vlada Karpovich

Boards look at technology through a very simple lens: risk, return, and clarity.

They are reading about AI every week. They see ransomware in the headlines. Many are now told, in plain language, that cyber risk is a board duty, not just an IT task. Research on strategic cybersecurity oversight frameworks for boards makes the same point in more formal terms, but the message is simple. They are accountable.

From your side of the table, especially in small to mid‑market companies, technology can feel like a black box that only gets more expensive. You are not alone. Benchmarks show security and tech spend rising, but confidence in results often lags behind. Many mid‑market leaders now use structured models like NIST CSF 2.0 to at least give the board a common language for cyber risk.

Your board does not expect perfection. They expect:

- A clear picture of your biggest risks and the moves that reduce them.

- A short list of tech bets that match the growth plan they already approved.

- A believable story about timing, cost, and delivery.

What they cannot tolerate for long is murky tradeoffs. For example, hearing that “we need AI” without a business use case, or that “security is underfunded” without a ranked list of gaps.

Mindset first, mechanics second. Once you see the world the way your board sees it, the framework becomes a shared map, not a technical report.

The three questions every board asks about tech and cyber spend

The exact words change, but in board and lender meetings the same three questions keep showing up.

- Does this protect the business from real risk?

Will this spend reduce the chance or impact of a serious event, such as a cyber breach, system outage, or regulatory failure? This is where security controls, backups, disaster recovery, and compliance work live. - Does this help us grow revenue or margin?

Does it make it easier to win, keep, and serve customers, or to run the business at lower cost? Think better data for sales, faster onboarding, or a smoother customer journey. - Can our team actually deliver it on time?

Is the scope realistic? Do we have the people, vendors, and focus to get it done without breaking day‑to‑day operations?

The Investment Priority Framework Boards Actually Use is simply a way to answer these three questions fast, using a single page. Instead of debating each project from scratch, you show where it sits, how it ranks, and what moves if you add or cut budget.

Why mid‑market tech roadmaps fail board scrutiny

Most tech roadmaps fail in the boardroom long before the first line of code.

Common patterns:

- Long feature wish lists that read like vendor brochures.

- No visible link between projects and the growth or profit plan.

- Cybersecurity items scattered everywhere, with no sense of “top three risks”.

- Delivery plans that boil down to “we’ll do it with the team we have”.

Picture three familiar examples:

- A cyber upgrade that asks for a bigger budget but cannot show which top risks it closes, or what changes in audit findings or downtime.

- An ERP replacement sold as “modernization” without explaining how it affects cash cycle, inventory accuracy, or customer promise dates.

- An AI pilot pitched around “efficiency” but with no baseline, no owner, and no date when it will prove value or shut down.

In each case, the board is left to guess. That guess is often “not now” or “cut this in half”. A simple, shared framework lets your CEO, CFO, and technology lead tell one consistent story and avoid that outcome.

The Investment Priority Framework Boards Actually Use: Four Buckets That Make Decisions Easy

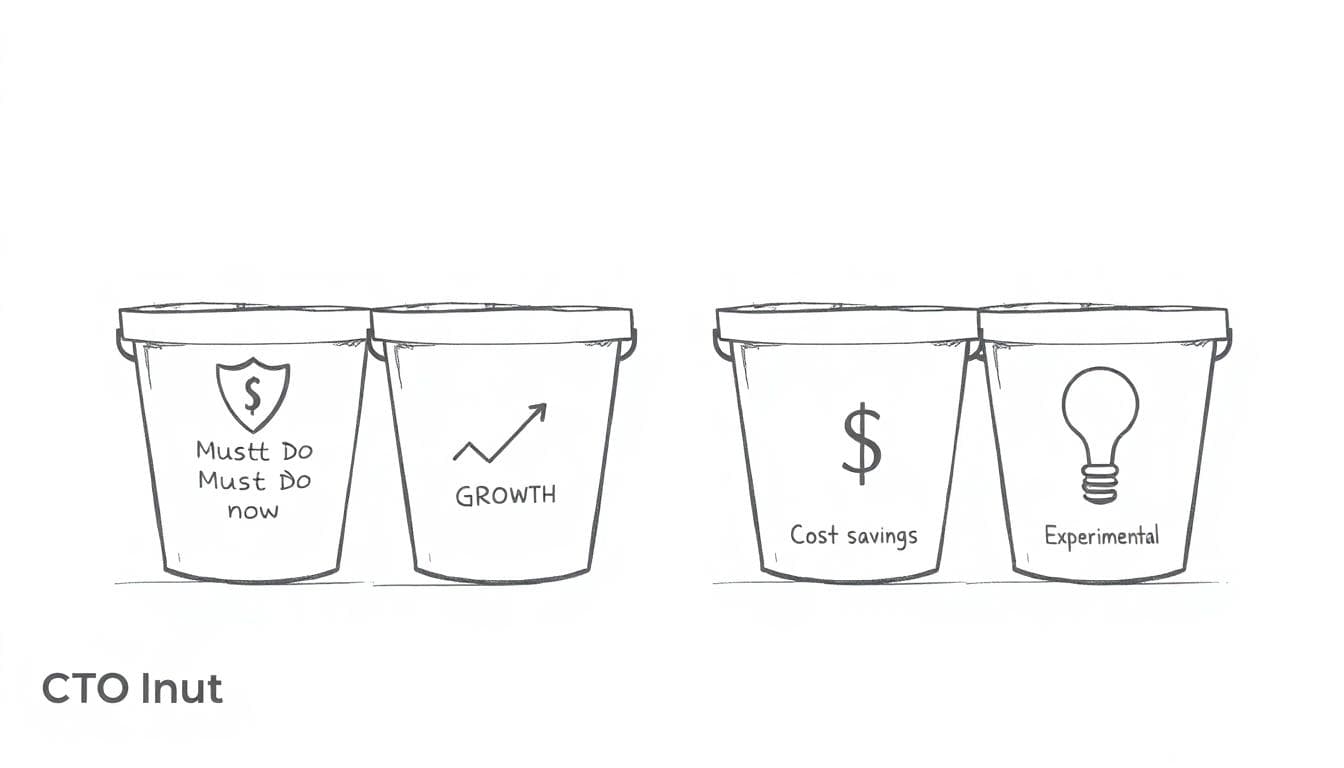

Four investment buckets for clear tech and cybersecurity decisions. Image generated by AI.

Here is the model you can use for every technology and cybersecurity initiative. Four buckets, in this exact order:

- Must do now to stay safe and compliant

- Strategic growth bets that support the plan

- Cost and complexity reducers that free up cash

- Experiments and nice to haves that can wait

Every project goes into one bucket. No exceptions. That simple rule forces the hard conversations you actually need.

Bucket 1: Must do now to stay safe and compliant

Bucket 1 is the “keep the lights on and avoid disaster” work.

Typical items:

- Closing high‑risk cybersecurity gaps, such as missing multi‑factor authentication or weak backups.

- Fixing unstable core systems that cause outages or data loss.

- Meeting regulatory or customer audit demands you have already accepted.

Boards see this as non‑negotiable. They are reading guidance from firms like Weaver on board questions for cyber, AI, and strategy. They know that ignoring clear risk can come back as personal liability.

In your board pack, label these items plainly as “Must do now”. Add one or two sentences describing the risk in business terms, such as “loss of card processing for 3 days” or “loss of key customer contract”.

Bucket 2: Strategic growth bets that support the plan

Bucket 2 holds the investments that make your growth story real.

Examples:

- A customer portal that reduces friction and makes it easier to buy, renew, or get support.

- A data platform that gives sales and operations better forecasting and pricing insight.

- Automation for onboarding that lets you scale without adding the same headcount every quarter.

Each item in this bucket must link to a clear, measurable business outcome. Revenue, margin, churn, or speed to market are good anchors.

Boards are already reading about how to oversee AI and digital initiatives, for instance in articles on board support for effective use of AI. When you show that a project backs the strategy they approved, they lean in instead of pushing back.

Bucket 3: Cost and complexity reducers that free up cash

Bucket 3 is about shrinking waste.

These projects:

- Retire old systems that cost too much to maintain.

- Consolidate vendors and tool sets.

- Automate manual work that eats time and creates errors.

- Move off overpriced platforms to something simpler and more flexible.

Boards like this bucket because it can self‑fund other work and improve EBITDA. Talk in simple ROI terms, such as “pays back in 18 months” or “saves 2 full‑time roles next year”, not in technical detail.

Many boards now ask for clearer technology governance, as seen in pieces on how corporate boards handle technology oversight. This bucket gives them the “good housekeeping” story they expect.

Bucket 4: Experiments and nice to haves that can wait

Bucket 4 is where bright ideas go to prove themselves, not to hijack the roadmap.

Think:

- AI pilots with no clear use case yet.

- Internal tools that help one team slightly, but do not move company‑level numbers.

- Features driven by vendor hype or internal preference, not customer need.

Boards do not hate innovation. They just want it capped and clearly separated from core and strategic work. Set a fixed, small budget for this bucket, for example 5 percent of total tech spend. If you want to add a new experiment, you drop or shrink another one.

Ranking projects inside each bucket with three simple scores

Buckets set the broad order. Inside each bucket, you still need to choose who goes first.

Use three scores, all on a 1 to 5 scale:

- Business impact (protect, grow, or save)

- Urgency (time pressure, regulation, or clear window of opportunity)

- Delivery confidence (team capacity, vendor risk, dependencies)

You can show this in a tiny table inside your board pack:

| Project | Bucket | Impact (1–5) | Urgency (1–5) | Delivery confidence (1–5) |

|---|---|---|---|---|

| Example initiative | 2 | 5 | 3 | 4 |

Sum the three scores, sort the list, and highlight the top items.

A one‑page priority map with simple scores that boards can read in minutes. Image generated by AI.

Your rule of thumb: the entire framework, including scores, must fit on one page. If it does not, you are explaining too much or managing too many projects at once.

How to Use This Framework With Your Board, Lenders, And Exec Team

Executives aligning on tech and cyber priorities using a shared framework. Image generated by AI.

This framework only pays off if you use it as the front page of every tech and cybersecurity discussion.

A CEO or COO can sit with their IT lead or a fractional CTO and build a single “investment map” of all major work. That map becomes the first page for board, lender, and exec‑team meetings. Detailed roadmaps and vendor slides come later, only for the projects the board agrees to move forward.

Use the same buckets and scores in conversations with vendors. When a vendor pushes a new module, you can calmly ask, “Which bucket would this sit in, and what score would it earn on impact and urgency?”

Build a one‑page investment map before the next board meeting

You can do this in a week.

- List all current and proposed tech and cyber initiatives over a set threshold, for example anything over $50,000 or 40 person‑days.

- Place each into one of the four buckets. Force a choice.

- Add the three scores for impact, urgency, and delivery confidence.

- Sort inside each bucket by total score.

- Highlight the top 5 to 7 items across all buckets as your focus for the next 12 months.

Clarity beats perfection. Your board will see, at a glance, how you are trading off cybersecurity, core systems, and growth projects instead of treating them as separate arguments.

Use the framework to say “not now” to low‑value work

The real power of this model is the language it gives you to say “not now”.

When a vendor or internal sponsor pushes a project, you can explain:

- It sits in the experiment bucket.

- It has low impact and low urgency scores.

- Budget is being held for higher impact items this year.

This is fair, honest, and transparent. Use the same language with your management team and investors. Over time, people start to self‑sort their ideas into the right bucket, and your roadmap conversations get calmer and sharper.

Conclusion

Boards do not need to read your architecture diagram. They need a clear view of what protects the business, what grows it, and what can wait. The Investment Priority Framework Boards Actually Use gives you that view in four buckets and three simple scores, on a single page.

If you build your own one‑page map and take it to the next board or lender meeting, you will feel the shift in the room. The conversation moves from “why is IT so expensive” to “which of these outcomes do we value most this year”.

If you want help applying this framework inside your own company, visit https://www.ctoinput.com to see how seasoned fractional CTO, CIO, or CISO support can sit on your side of the table. Keep learning by exploring more articles and practical playbooks on the CTO Input blog at https://blog.ctoinput.com.