A business impact analysis (BIA) isn’t a technical audit. It’s a financial x-ray of your company. Think of it as a business-first process designed to pinpoint your most critical operations and calculate, in real dollars, what it costs you when they fail. The goal isn't to create a list of servers; it's to map how money flows through your organization and quantify the risk of anything stopping that flow.

For a CEO, COO, or founder, this isn't about jargon. It's about knowing where a single point of failure could halt your entire operation and making smart trade-offs to protect your revenue.

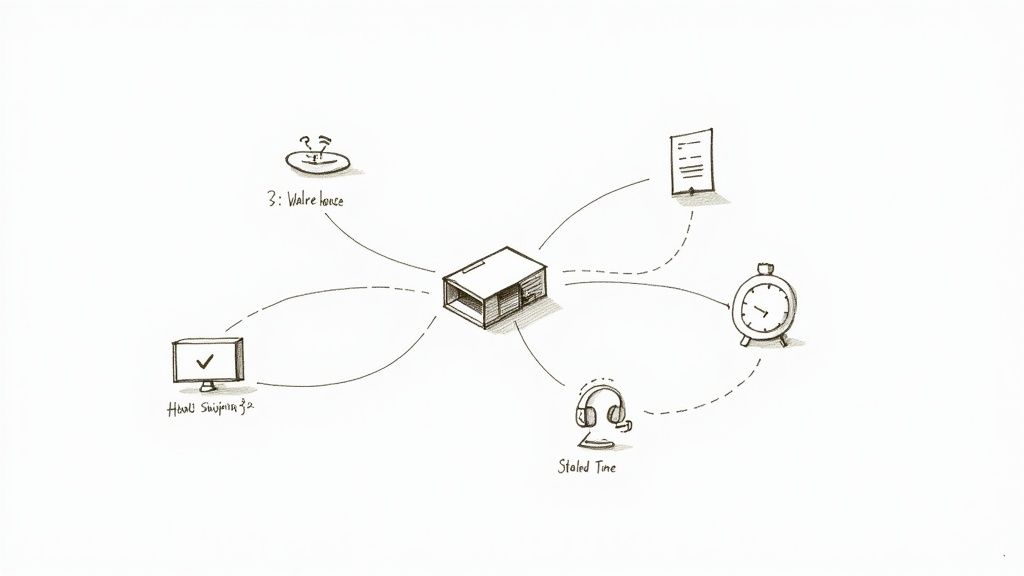

When a "Small Glitch" Halts Your Entire Business

It’s a typical Tuesday afternoon. In a forgotten closet, a single server quietly gives up. No smoke, no drama—it just stops working.

But the ripple effects are immediate and painful. Your warehouse can't print shipping labels, bringing fulfillment to a standstill. The finance team is locked out of the ERP, unable to generate invoices. Your sales team is flying blind because the CRM is offline. The real problem isn't the dead server; it's the web of a dozen hidden dependencies you never even knew existed.

This kind of quiet chaos is a familiar fear for leaders of growing companies. You feel the operational risks lurking just beneath the surface, but they’re almost impossible to pin down on a balance sheet until it’s too late. A BIA is the tool that drags these hidden risks out into the open, turning vague anxiety into a clear, actionable plan.

From Guesswork to a Financial X-Ray

A BIA forces you to draw a straight line from every operational process directly to revenue. Instead of relying on gut feelings, you can finally answer some of your toughest questions with real data:

- Which processes are truly essential? This isn't about what's important; it's about what's mission-critical. You can finally separate the vital few from the trivial many.

- What does downtime actually cost us? You move beyond "it's bad" to a specific cost-per-hour for any critical function going offline. This is the language your board and CFO understand.

- Where are our biggest vulnerabilities? You get a clear map showing which specific systems, people, or third-party vendors pose the greatest threat to your revenue stream.

Ultimately, a BIA is about making smart, proactive decisions before a small glitch spirals into a catastrophe. This clarity separates companies that survive major disruptions from those that don't—a lesson made painfully clear during major service outages. If you want to see how quickly things can unravel for businesses that depend on a single vendor, there are valuable lessons from the OpenAI and Mixpanel incident.

More Than Just a Disaster Recovery Plan

When most leaders hear "business impact analysis," their minds jump to disasters—floods, fires, a massive cyberattack. That’s the world of a Disaster Recovery (DR) plan, a vital but very different tool.

A DR plan is purely reactive. It answers one question: “How do we get back up and running after a catastrophe?” It's the technical playbook you pull out when the building is flooded or servers are fried.

A Business Impact Analysis (BIA), on the other hand, is proactive and strategic. It doesn't start with a hypothetical disaster. It begins with a single, brutally pragmatic question aimed at every part of your company:

“If this specific business process stopped right now, how much money would it cost us per hour?”

That simple shift in focus changes everything. It pulls the conversation out of abstract "what-if" scenarios and grounds it firmly in the financial reality of your day-to-day operations. A DR plan worries about getting the building back online; a BIA worries about the cost of every minute your top sales team can’t access the CRM.

A Financial Blueprint for Operational Risk

Think of a BIA as a financial x-ray of your company. It exposes hidden operational vulnerabilities by connecting every function—from marketing lead generation to warehouse fulfillment—directly to a dollar value. You might discover that a seemingly minor internal process is the lynchpin for a huge chunk of your monthly revenue, making its failure just as costly as a headline-grabbing catastrophe.

- A DR Plan Focuses On: Recovering infrastructure after a major event. Example: restoring servers from a backup after a fire.

- A BIA Focuses On: Quantifying the financial impact of a process outage. Example: calculating the revenue lost for every hour the invoicing system is down.

By analyzing these impacts, you stop talking about abstract risks and start making concrete business trade-offs. The results give you a clear, data-backed hierarchy of what to protect first. This allows you to have intelligent conversations about where to invest in new technology, security, and resilience—not based on fear, but on a precise understanding of what keeps your business profitable.

This isn't an IT exercise; it's a foundational piece of your financial and operational strategy. The BIA provides the hard numbers you and your board need to make confident decisions, ensuring every dollar spent on technology is directly protecting or enabling revenue. You stop guessing where your biggest risks are and start knowing.

The Three Questions Every BIA Must Answer

A good Business Impact Analysis isn't a hundred-page report that collects dust. It's a living document, a focused process that gives leaders clear answers to three questions that directly shape strategy, security, and budgets. Get these right, and you have a powerful decision-making tool.

Question 1: Which Business Processes Actually Drive Our Revenue?

First, you need to get real about what keeps the lights on. This is a ruthless prioritization exercise that forces your leadership team to break out of their departmental silos and see the business as a single, revenue-generating machine. You have to separate the functions that are truly vital from those that are merely important.

Is the ability to process online payments more critical than the internal HR portal? Of course. Is keeping the warehouse fulfillment system running more vital than the marketing analytics platform? Absolutely. This isn't about offending anyone; it's about acknowledging which activities stop the company from making money the second they go down.

Question 2: How Long Can We Realistically Be Down? (Your RTO)

This question gets to the heart of your Recovery Time Objective (RTO). In plain English, it’s the maximum acceptable downtime for a critical process before the business suffers serious, potentially irreversible, financial or reputational damage. This is a business metric, not a technical one.

- For an e-commerce checkout system, the RTO might be less than 15 minutes. Every minute of downtime is lost sales.

- For a payroll system that runs twice a month, the RTO could be up to 48 hours. It's critical, but not immediate.

An RTO of two hours for your sales CRM means you need a plan—and the budget—to get it back online within that window. An RTO of two days allows for a completely different, and likely far less expensive, recovery strategy. This is where you see the BIA informing business decisions, not just technical ones.

As you can see, a BIA uses financial impact to define recovery needs. A DR plan is all about the technical steps to fix what’s broken. You need both, but the BIA must come first to guide the DR plan.

Question 3: How Much Data Can We Afford to Lose Forever? (Your RPO)

Finally, we have to tackle the Recovery Point Objective (RPO). This metric quantifies the maximum acceptable amount of data loss, measured in time. If your system crashed right now, could you afford to lose the last hour of transactions, or could you get by recreating the last 24 hours of work from other sources?

An RPO of five minutes for your order entry system demands near-constant, real-time data replication—a significant investment. In contrast, an RPO of 24 hours might be perfectly fine for an internal project management tool, which can rely on simple nightly backups.

Answering these three questions translates abstract risks into tangible, dollars-and-cents metrics. It's the language that connects your operations to the CFO’s budget and the board’s tolerance for risk.

BIA Core Outputs Explained

| Metric (Output) | What It Means in Plain English | Example Business Decision It Drives |

|---|---|---|

| Critical Process Identification | The list of functions that absolutely must run for the company to make money and operate. | Prioritizing security hardening and modernization funds for the top 5 revenue-generating applications. |

| Recovery Time Objective (RTO) | The maximum time a system can be offline before it causes unacceptable business harm. | Deciding whether to invest in a costly high-availability cloud setup (15-min RTO) or a standard backup/restore plan (8-hour RTO). |

| Recovery Point Objective (RPO) | The maximum amount of data, measured in time, that can be lost without causing major damage. | Justifying the budget for real-time data replication (5-min RPO) for the customer database vs. nightly backups (24-hour RPO) for the dev server. |

| Financial & Operational Impact | The quantified cost of downtime per hour/day for each critical process (e.g., lost revenue, fines). | Approving a $50,000 disaster recovery solution because the BIA proves downtime costs the company $100,000 per hour. |

These metrics give you the hard data needed to justify technology investments, optimize security controls, and even manage vulnerabilities introduced by your vendors. The insights are especially critical for managing third-party cyber risk for executives, as it helps you pinpoint which vendor relationships pose the greatest financial threat to your operations if they were to fail.

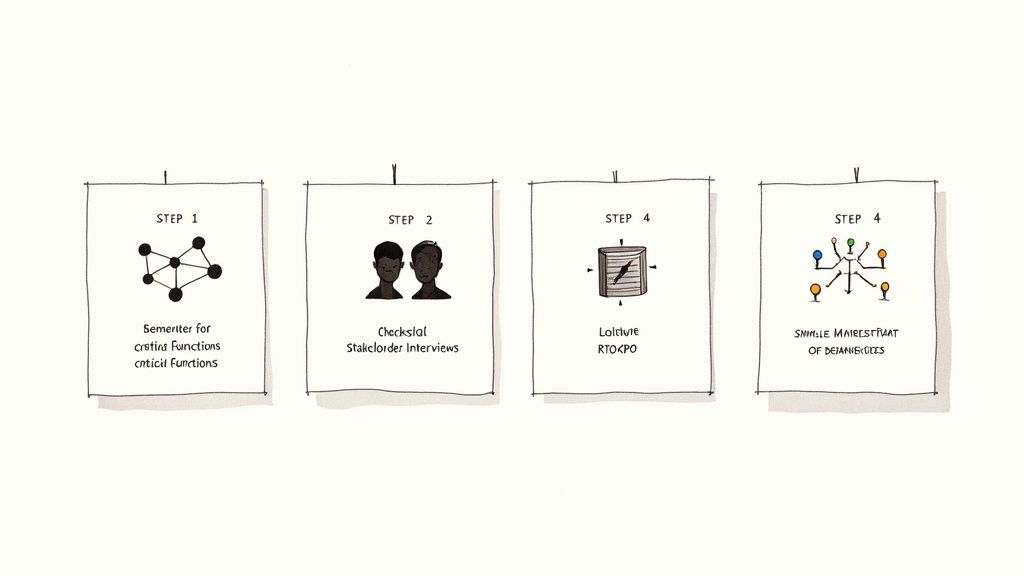

Your Pragmatic 4-Step Plan for Completing a BIA

Running a business impact analysis doesn't need to be a six-month consulting engagement. For most growing companies, you can get 80% of the value with a focused internal effort over the next 30 to 90 days. The goal isn't a flawless document; it’s a practical tool that helps you make smarter decisions.

This isn't about adding bureaucracy. It’s about building a shared, crystal-clear understanding of what keeps the lights on so you can protect it effectively. Here's a simple, four-step framework your leadership team can own.

Step 1: Identify Your Critical Functions

Get your entire leadership team in a room—sales, finance, operations, everyone. The mission is to map out your primary revenue streams. This isn’t an IT exercise; it's a core business strategy session. For each way your company makes money, ask one question: "What absolutely has to happen for us to deliver this and get paid?"

You aren't trying to list every task. You're hunting for the handful of high-level functions that, if stopped, would bring your cash flow to a screeching halt.

- For a manufacturing company: This is likely order processing, production line scheduling, and warehouse shipping.

- For a SaaS business: Think user authentication, core application functionality, and subscription billing.

Your output should be a tight, prioritized list of no more than 10-15 critical business functions. This first step forces a level of focus that makes the rest of the analysis far more effective.

Step 2: Conduct Stakeholder Interviews

Now that you have your list, talk to the people who live and breathe these processes every day. Your head of sales knows the real-world pain of the CRM going down far better than anyone in the tech department. The goal of these conversations is to put a number on that pain.

Schedule 30-minute chats with the leaders of each critical function. Don't ask technical questions. Ask business questions.

Frame the discussion around time. Ask them to walk you through the impact of their primary system being offline for one hour, then four hours, then a full day. This forces them to think in concrete, escalating terms instead of just saying "it's important."

Dig into the specific consequences:

- Financial Impact: How much revenue do we lose outright? Are there contractual penalties or fines?

- Operational Impact: Can we still serve customers? Will we create a huge backlog that costs a fortune in overtime to clear?

- Reputational Impact: How many customers are affected? Will our brand take a hit? Will we violate an SLA?

These interviews turn vague anxieties into hard data.

Step 3: Define Your RTO and RPO

With the interview data in hand, your leadership team can now establish official Recovery Time Objectives (RTO) and Recovery Point Objectives (RPO). This is where you look at the quantified impacts and make some tough calls. A department head might feel their process is the most critical, but the data will show its real RTO is 24 hours, not one. This is how you move from opinions to objective business requirements.

- Recovery Time Objective (RTO): Based on the financial and operational pain, what’s the maximum acceptable downtime for each function?

- Recovery Point Objective (RPO): Looking at the data involved, what's the maximum amount of data—measured in time—that we can afford to lose? An hour's worth? A day's worth?

This step is about getting agreement from the CEO, COO, and CFO. They need to look at the numbers and collectively say, "Yes, we can live with the warehouse being down for four hours, but eight hours is unacceptable." These numbers become the official targets for your tech and operations teams.

Step 4: Map Dependencies and Gaps

The final step connects your business requirements to your technical reality. For each critical function—especially those with the tightest RTOs and RPOs—your team needs to map out every single dependency. Identify the exact software, servers, key people, and third-party vendors that each process relies on.

Once that map is built, you compare your required RTO and RPO against what you can actually deliver today. This is the moment of truth. You might discover that your sales CRM, which the business says needs an RTO of one hour, is only backed up once a night. That’s a 24-hour RPO for a one-hour RTO system—a huge gap and a serious risk.

This final step hands you a clear-cut action plan. It highlights the precise mismatches between what the business needs and what your technology provides, giving you a data-driven, prioritized list of your biggest risks to tackle first.

Turning BIA Findings Into Smart Investments

The real power of a business impact analysis isn't the report. It’s the confident, data-driven decisions it unlocks. The findings should feed directly into your strategic planning, budgeting, and technology roadmaps, turning a theoretical exercise into a practical tool for building a more resilient, profitable company.

You're no longer relying on gut feelings or the latest vendor pitch to justify spending. You have a clear, objective case for every investment.

From Vague Risk to a Specific Business Case

Imagine your BIA reveals that your entire shipping operation—with an RTO of just four hours—runs on a single, aging server with no failover. The conversation with your CFO is now entirely different. You're not asking for "new servers." You're proposing a $25,000 investment to protect a $5 million per month revenue stream from a very real, very probable point of failure.

Or maybe you discover the sales team is dead in the water without the CRM (RTO: one hour), but your backups only run nightly. That gives you a Recovery Point Objective (RPO) of 24 hours. The massive gap between what the business needs and what IT can deliver represents a huge, quantifiable risk. The BIA provides the undeniable business case to upgrade your backup strategy, directly tying the cost to protecting sales productivity.

The BIA translates technical risks into the language of the C-suite: cost, revenue, and operational continuity. It allows the CFO to see a clear ROI on a security investment and gives the CEO confidence that capital is protecting the most valuable parts of the business.

This clarity is crucial when departments are competing for a slice of the budget. You can now make informed trade-offs based on objective data, not just on who shouts the loudest. A pragmatic way to approach this is by using a 4-step system to prioritize urgent tech investments based on value and risk.

Bridging the Data Gap

A good BIA also shines a light on hidden operational drags, like poor data management. Data quality issues and a lack of integration can seriously undermine the very processes you've identified as critical. For example, industry stats show that data silos can cost organizations millions in lost productivity as people waste hours hunting for information scattered across disconnected systems. You can find more on how data challenges impact business on integrate.io.

A BIA finding might show that your "critical" inventory management process is constantly slowed by manual data entry from three different platforms. That builds a powerful business case for an integration project that directly boosts efficiency and cuts down on costly errors.

From BIA Finding to Business Action

| BIA Finding | Identified Risk | Resulting Action or Investment |

|---|---|---|

| CRM RTO is 2 hours, but current IT recovery capability is 8+ hours. | Lost Sales & Productivity: Sales team is offline for an entire business day, missing targets and frustrating customers. | Approve budget for a cloud-based CRM with a high-availability service level agreement (SLA) to meet the 2-hour RTO. |

| Finance department relies on a single person to run a critical month-end reporting process. | Single Point of Failure: If that person is sick or leaves, financial reporting and compliance are jeopardized. | Fund a cross-training initiative and document the process to build redundancy and reduce key-person risk. |

| Order fulfillment system (RPO of 15 mins) is only backed up nightly (RPO of 24 hours). | Significant Data Loss: A server failure could wipe out an entire day of orders, requiring costly manual recreation and causing shipping delays. | Invest in real-time data replication technology for the fulfillment system to align the RPO with business needs. |

Each action is a direct consequence of a BIA finding. You're no longer spending on technology for technology's sake. You’re making strategic investments to stamp out the precise risks that threaten your revenue and reputation. This is how you turn your tech stack from a source of chaos into a true strategic advantage.

The Real Cost of Flying Blind

Skipping a business impact analysis isn't just deferring an exercise; it's a high-stakes bet against your own business. Without that clarity, you're flying blind, making critical decisions based on gut feelings and outdated assumptions about where your real vulnerabilities lie.

This is how small problems snowball. A minor tech glitch that should have been a quick fix cascades into a company-wide outage. Each incident tests your customers' patience, chips away at your reputation, and burns out the very people you rely on to fight fires.

The Slow Bleed on Your Bottom Line

When you don’t have a clear map of your most critical processes, you're guaranteed to misallocate capital. You overspend on flashy new tech that doesn't move the needle while neglecting the unglamorous, foundational systems that actually keep the lights on. It’s a classic recipe for wasted budget.

Then, when the inevitable happens—a key supplier fails, a new regulation drops—your more prepared rivals bounce back faster. They use the disruption to gobble up market share while you’re still figuring out what just hit you.

A business that has done a BIA makes confident, calculated decisions. It puts money where it matters and builds an operational backbone that both customers and investors can rely on. This analysis isn't just another expense; it's the bedrock for predictable growth.

In the end, the company that has done the work knows exactly what’s on the line. They can act decisively, shield their core revenue streams, and maintain momentum. They aren't just surviving; they're building an organization engineered to thrive.

The choice is stark: either you define your risks, or eventually, your risks will define you.

Your Questions, Answered

Even after seeing the value, it's smart to have a few practical questions before committing to a business impact analysis. You need to be sure any strategic exercise is worth your team’s time and will contribute to stronger, more predictable growth. Here are the most common questions we hear from leaders.

How Is a Business Impact Analysis Different from a Risk Assessment?

This is the most frequent question, and the distinction is crucial.

A risk assessment is like a weather forecast. It scans the horizon for potential threats—a cyberattack, a power outage, a supply chain failure—and tries to guess how likely they are to happen. It’s all about what could go wrong.

A business impact analysis (BIA) assumes the storm has already hit. It asks a much more practical question: "So, what now?" The BIA zeroes in on the financial and operational fallout of a disruption, no matter the cause.

- A Risk Assessment asks: "What's the likelihood of a ransomware attack?" It's focused on potential threats.

- A Business Impact Analysis asks: "If our payment system goes down for any reason, how much money do we lose per hour?" It's focused on the tangible cost of an outage.

You need both, but starting with the BIA is almost always the right move. It tells you which parts of your business are the most valuable before you worry about all the different ways they could be threatened.

Do We Really Need a Formal BIA as a Mid-Sized Company?

Yes. It’s arguably more critical for a growing business than for a massive enterprise. Large corporations often have deep cash reserves and redundant systems to absorb the shock of an outage. For a mid-sized company running lean, the failure of a single critical system can have a disproportionately large—and sometimes fatal—impact.

A pragmatic BIA for a company your size isn’t a hundred-page bureaucratic report. It's a focused process designed to give you maximum clarity with minimum friction.

It’s about making sure every dollar you spend on technology and security is aimed directly at protecting the true engine of your growth. You get the most resilience for your dollar, avoiding the waste of over-investing in non-critical areas.

This analysis gives you the hard data needed to make smart, surgical investments that keep your company running.

How Often Should We Update Our Business Impact Analysis?

A BIA is not a one-and-done project. Your business is constantly evolving, so your analysis must evolve with it. Think of it as a living document.

As a rule of thumb, plan a full review annually, ideally right before your strategic planning and budgeting cycle. This ensures your priorities for the coming year are grounded in an up-to-date understanding of your operational realities.

However, certain events should trigger an immediate, targeted review:

- Launching a major new product line or service.

- Implementing a new core system, like an ERP or CRM.

- Acquiring another company or entering a new market.

This discipline ensures your BIA keeps pace with your ambition.

Who Should Be Involved in a Business Impact Analysis?

This might be the most important question, because the answer determines whether your BIA succeeds or fails. An effective BIA is a cross-functional team sport, not an IT-only project.

While your CTO or Head of IT should facilitate the process, their role is to gather and translate the information. The real insights must come from your business leaders.

Active, engaged participation from the heads of sales, finance, operations, and customer service is non-negotiable. They are the only people who can accurately quantify the real-world impact of a disruption in lost sales, customer frustration, and operational chaos. When your business leaders own the outcomes, the BIA transforms from a technical document into a powerful tool for strategic alignment.

A business impact analysis demystifies risk, replacing gut-feel decisions with data-driven clarity. It provides the financial blueprint for building a company that can weather any storm. If you're ready to stop guessing where your biggest operational risks are and start building a more predictable, resilient business, the team at CTO Input can provide the experienced guidance to get it done right. We translate technical complexity into clear business trade-offs, giving you a practical roadmap to protect what matters most.

Schedule a no-pressure discovery call with CTO Input today to see how we can help you turn technology from a source of anxiety into your greatest strategic advantage.