You probably feel it every budget season. Technology costs keep rising, risk headlines keep getting louder, and your CFO looks at your plans with a mix of interest and suspicion.

For mid‑market and growth companies, tech feels expensive, risky, and strangely disconnected from the real growth plan. The board wants clear answers. The CFO wants numbers. Your team wants tools. You sit in the middle.

This is where a tech roadmap either builds trust or burns it. In simple terms, a tech roadmap is a time‑phased plan that shows how your technology investments will support revenue, profit, risk, and scale, not just what tools you want to buy. This article walks through how to design a roadmap your CFO can defend, because it is tied to money, risk, and company goals.

Image created with AI: a CFO and tech leader align on a shared tech roadmap.

What Your CFO Really Wants From a Tech Roadmap

Your CFO is not judging your tech roadmap as a technical document. They see it as a multi‑year financial commitment that affects cash, margins, and risk.

Their questions sound like this:

- How much cash will this tie up, and when?

- What do we get back, and how quickly?

- What risks does this reduce, and which ones does it add?

CFOs are under pressure to support growth while holding the line on cost and risk. Articles on the modern CFO roadmap for growth and risk balance show how often they are asked to stretch beyond finance into strategy, cyber, and operations. Your tech roadmap either helps them carry that load or adds to the noise.

From project list to investment plan: how a CFO sees your tech roadmap

Many tech leaders present a roadmap as a list of projects: ERP upgrade, CRM revamp, cloud migration, security program. For your CFO, this is not a feature list. It is an investment portfolio.

- ERP upgrade: Is this about faster close, fewer billing errors, or headcount savings in finance and operations? How much downtime risk sits in the legacy system?

- Cloud migration: Will this reduce data center spend, improve uptime, and support future products, or is it just “modern” for its own sake?

- Security program: Which specific risks drop, and how does that change our exposure in front of lenders, insurers, and the board?

The moment you translate each project into growth, savings, or risk reduction, you are speaking in portfolio terms, not tech terms.

Key finance concepts to speak your CFO’s language

You do not need to be a finance expert. You only need a few core ideas:

- ROI (return on investment): How much you get back compared to what you spend. An automation that costs $200k and saves $100k per year has a simple 2‑year ROI.

- TCO (total cost of ownership): All costs over time, not just the license. A new system with lower fees but high support effort might have a higher TCO than you think.

- Payback period: How long before savings or new revenue cover the initial cost. A workflow tool that pays for itself in 9 months gets attention.

- Cash flow impact: When cash leaves the bank and when benefits show up. A project that saves money is still a problem if it needs big cash out in a tight quarter.

- CapEx vs OpEx: CapEx is capital spend, like a big implementation. OpEx is ongoing expense, like subscriptions and support. Your roadmap should show the rough mix.

Finance leaders already think this way about automation and process change. For example, a CFO guide to finance automation ROI uses the same concepts your roadmap should use for tech across the business.

Why trust breaks down between CFOs and technology leaders

Trust often fails for the same few reasons:

- Vague business cases: “Improve scalability” does not answer the board’s question, “By how much, and to what end?”

- Changing scope: Projects balloon without clear guardrails, so costs drift and timelines slip.

- Surprise costs: Integration fees, data cleanup, extra licenses. The CFO feels ambushed.

- Ignored risk: Cyber, outages, vendor lock‑in. If the only time you discuss risk is after an incident, confidence drops.

- No clear owner for benefits: Nobody is on the hook to turn “potential savings” into actual P&L impact.

Your tech roadmap must show that you see these patterns and plan to avoid them.

Step-by-step: How to Build a Tech Roadmap Your CFO Actually Trusts

Image created with AI: a simple five‑step flowchart for building a CFO‑ready tech roadmap.

Start with a clear current-state assessment that exposes cost and risk

You cannot ask your CFO to back a new plan if you cannot explain the current one.

Map your current environment in business terms:

- Systems and vendors for core processes, like sales, billing, operations, and support

- Pain points, like outages, failed orders, slow onboarding, and manual rework

- Risk areas, like single points of failure, old servers, weak security controls, or compliance gaps

Pull a few simple, concrete numbers:

- Annual support and license spend by system

- Number of incidents or outages per quarter

- Hours per month spent on manual tasks or data fixes

This gives you a baseline: what technology costs today, where it slows the business, and where risk is highest. Your CFO now has a starting point, not a black box.

Translate company goals into concrete technology outcomes

Too many roadmaps start with tools instead of goals. Start with the business plan.

Take the 3 to 5 top company goals, often things like:

- Revenue growth in a target segment

- Margin improvement in a key product line

- Better customer experience or NPS

- Stronger compliance posture for a new market

Then define tech outcomes that support each one. For example:

- “Hit 20 percent growth in mid‑market accounts” becomes “faster onboarding, with contract‑to‑live time cut from 30 days to 10, supported by better integrations between CRM, billing, and provisioning.”

Now your tech roadmap connects directly to targets the CFO already tracks.

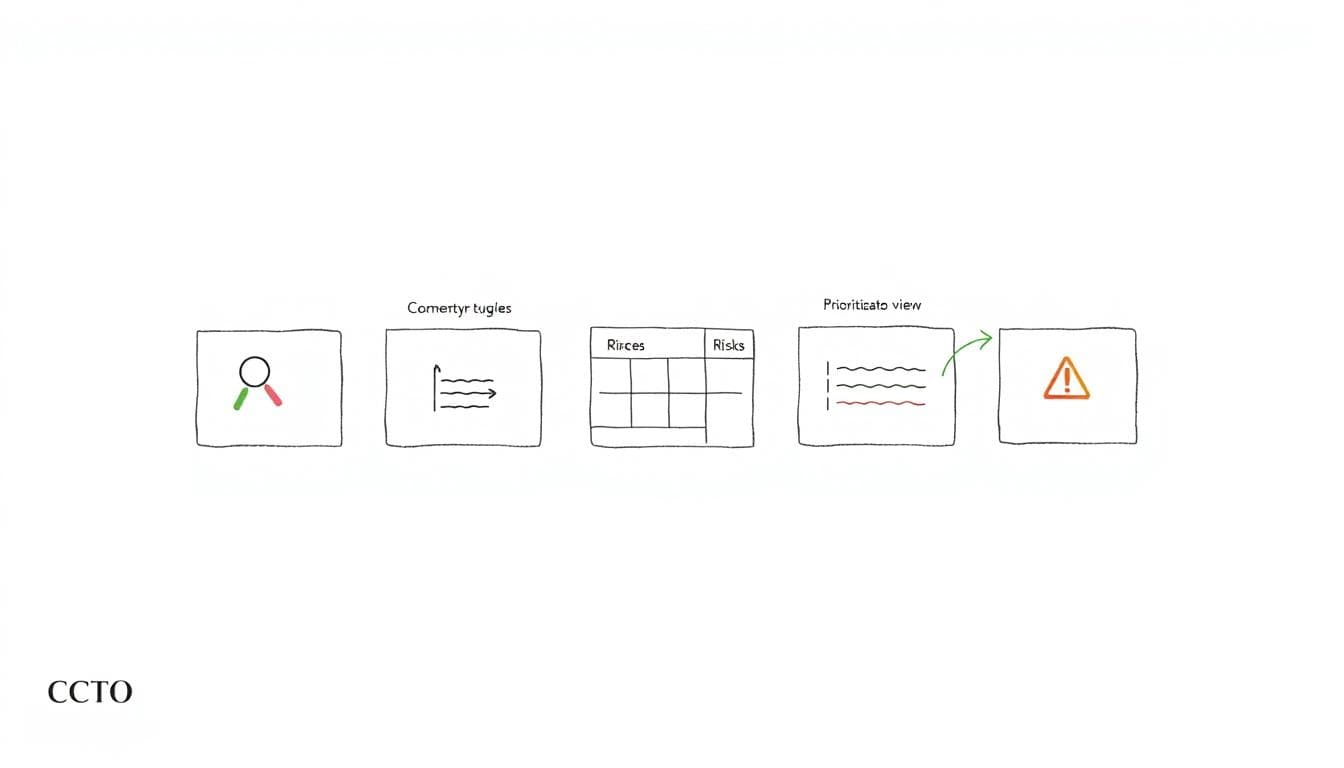

Prioritize initiatives using value, cost, and risk, not loudest voice

Next, list possible initiatives and score them on four simple factors:

- Business impact

- Cost to deliver

- Risk reduction

- Urgency or regulatory pressure

Use a simple 1 to 5 score, not a complex model. Sort the list and group work into:

- Quick wins (0 to 90 days): Small, cheap fixes that reduce pain or risk fast.

- Mid‑term projects (6 to 12 months): Visible improvements in revenue, margin, or customer experience.

- Foundational work: Data, security, or infrastructure that unlocks future value.

Imagine a cloud migration. It might sit in foundational work, but if it also cuts outages that hit revenue, it moves higher on the list. You now have a story that balances value and risk, not politics.

Build a basic financial view for your tech roadmap

Now, give your CFO the picture they need for budgeting. Group roadmap items into quarters or years and estimate costs and benefits at a rough level.

A simple table for a small automation program could look like this:

| Initiative | Year 1 Cost | Year 1 Benefit | Year 2+ Annual Benefit | Payback Period |

|---|---|---|---|---|

| Billing workflow automation | $180,000 | $90,000 | $120,000 | 18 months |

Call out:

- Expected CapEx vs OpEx by year

- Where savings show up, such as reduced overtime or avoided hires

- Any revenue upside, even if it starts as a conservative range

Guides on CFO budget planning for middle‑market firms show how much finance leaders value forward views like this, even when numbers are estimates.

Make risks, dependencies, and trade-offs explicit

Your CFO knows every plan has risk. Trust grows when you name it.

For each major initiative, list:

- Key dependencies, like vendor delivery, data cleanup, or hiring a certain skill

- Main risks, like migration downtime, user adoption, or cyber exposure during a cutover

- Clear trade‑offs, such as “if we fund this data platform now, we will pause this less‑critical reporting project”

Include a small section labeled “Assumptions, risks, and what we will not do now.” For example:

- “New customer portal postponed until security uplift and API layer are in place”

- “Cloud migration for core app depends on vendor feature X by Q2”

This gives your CFO informed choice instead of hidden risk.

Turn Your Tech Roadmap Into a One-page Story Your CFO Can Defend

A strong tech roadmap is not just a plan. It is a story your CFO can repeat to the CEO, the board, lenders, and auditors without fear.

Create a one-page executive tech roadmap your CFO can share with the board

Your one‑pager should be clean and visual, not a wall of text. Include:

- 3 to 5 top business objectives

- 5 to 10 key initiatives, grouped by objective

- Timeline by quarter, at a high level

- Rough cost bands, like low, medium, high

- 3 to 5 metrics that show value, such as fewer outages, faster month‑end close, reduced manual hours, better NPS, fewer security incidents

Think of it as a board‑ready snapshot. Everything else is backup.

Add a lightweight financial and metric view behind the one-pager

Behind that one page, keep a short supporting pack. One or two slides per major initiative is enough, with:

- Estimate of ROI over 3 to 5 years

- Simple TCO view, like build vs buy or vendor A vs vendor B

- Payback period and cash timing for the top 3 to 5 bets

- Key assumptions that would change the math

This is the material your CFO uses when investors ask how the company is using technology to support growth and control risk, similar to what many CFO transformation playbooks recommend on the finance side.

Build trust over time with transparency, cadence, and small course corrections

Getting the roadmap approved is not the finish line. It is the start of a new working rhythm with your CFO.

Set a recurring review, monthly or quarterly, where you:

- Share a simple dashboard with progress, spend, and key metrics

- Highlight where costs, scope, or timelines have moved, and why

- Offer options, such as slowing one project to accelerate another when conditions change

- Walk through basic scenarios, like a revenue slowdown, a major security issue, or a big new customer need

When your CFO sees you surface problems early, propose small corrections, and connect decisions back to the same one‑page story, you stop being “the IT person” and start becoming their most trusted partner on technology and risk.

Conclusion

A tech roadmap your CFO actually trusts is not a glossy diagram. It is a clear, honest plan that links technology to money, risk, and strategy in a way any board member can follow.

Speak your CFO’s language, using simple ideas like ROI, TCO, payback, and cash flow. Tie every major initiative to a concrete business outcome and show how the pieces fit into a living plan with regular reviews and simple metrics. You do not need perfect data to start, only a shared, believable view of cost, risk, and value.

If you want help turning your current project list into a roadmap your CFO can defend with confidence, visit https://www.ctoinput.com. For more practical, no‑nonsense guidance on technology, risk, and growth, explore the CTO Input blog at https://blog.ctoinput.com.