The deal looks perfect on paper. The financials are strong, the market is growing, and the strategic fit seems undeniable. For a growth-focused leader, this is the moment where ambition meets opportunity. But a nagging question lingers in the back of your mind: What am I missing?

You’ve seen it happen. A friend acquired a company, only to discover a year later that the core software was a tangled mess of technical debt, impossible to scale. The “landmark” acquisition turned into a multi-year, seven-figure headache. The pressure to close is immense, but the risk of moving too fast without a clear picture is even greater. You’re smart, you’re busy, and you know a standard financial audit won’t cut it. You need a pragmatic way to look behind the curtain.

This isn’t about finding reasons to kill the deal. It’s about going in with your eyes wide open, ready to mitigate risks and seize opportunities from day one. This guide provides a comprehensive due diligence checklist for acquisition that protects your investment and ensures the company you acquire becomes the asset you expect. We’ll walk through the critical areas that demand scrutiny, moving beyond the balance sheet to give you the clarity and confidence to make the right call. Each section is designed to be actionable, helping you ask the right questions and build a post-close integration plan that works.

1. Financial Due Diligence: Is the Money Real?

Financial due diligence is the cornerstone of any acquisition. This isn’t a simple review of financial statements; it’s a forensic examination of the numbers. The goal is to uncover hidden liabilities, confirm profitability, and validate the assumptions driving your valuation. It’s about ensuring the company you think you’re buying is the company you actually get.

A thorough financial review within your due diligence checklist for acquisition validates revenue recognition policies, assesses the quality of earnings, and inspects the balance sheet for unrecorded debts. This is where you might discover that a company’s impressive revenue was inflated by aggressive accounting, or that its working capital is dangerously tied up in accounts receivable that will never be collected.

Why It’s a Critical First Step

Ignoring this phase is a recipe for disaster. An acquirer might find themselves saddled with undisclosed debt that drains cash flow or discover that projected synergies were based on flawed forecasts. For instance, a private equity firm might uncover that a target’s EBITDA was artificially inflated by capitalizing expenses that should have been recognized immediately, fundamentally altering the deal’s valuation.

Actionable Tips for Financial Diligence

- Engage Forensic Accountants: Don’t rely on your internal team alone. Bring in experienced M&A financial advisors. Their job is to find red flags a standard audit might miss.

- Demand Audited Statements: Always request at least three years of audited financial statements. If they’re unavailable, it’s a significant risk. The rigor of an independent audit provides a higher level of assurance, a concept we explore in our breakdown of SOC reports.

- Benchmark Against Peers: Compare the target’s key financial metrics (e.g., gross margins, operating expenses) against industry benchmarks. Outliers need clear explanations.

- Investigate Variances: Demand data-backed explanations for any significant year-over-year fluctuations in revenue, costs, or profitability.

- Verify Accounting Policies: Ensure the target’s accounting policies are consistent and conservative. Inconsistent policies can obscure true performance.

2. Legal and Regulatory Compliance: Are There Hidden Lawsuits?

Legal due diligence is the process of examining a target company’s legal health. This review goes beyond corporate paperwork; it’s a critical investigation into the company’s right to operate, its litigation history, and its exposure to regulatory penalties. It ensures you aren’t acquiring a business entangled in costly legal battles.

A comprehensive legal review within your due diligence checklist for acquisition scrutinizes everything from corporate governance and contracts to intellectual property ownership and data privacy. This is where you might uncover that a key patent is about to expire, a “minor” lawsuit could become a class-action nightmare, or the company has been operating without a mandatory permit.

Why It’s a Critical Step

Overlooking legal due diligence is like buying a house without a title search. You could inherit massive liabilities. An acquirer might discover post-close that the target company violated sanctions, leading to severe government fines, or that its data handling practices breach GDPR, risking reputational damage. A fintech acquirer might find the target lacks proper state-by-state licenses, rendering its core business model illegal in key markets.

Actionable Tips for Legal and Regulatory Diligence

- Engage Specialized Counsel: Retain a law firm with deep expertise in the target’s specific industry (e.g., healthcare, finance). Their knowledge is crucial for identifying nuanced risks.

- Verify All Licenses and Permits: Review all material licenses and permits. Confirm they are current, in good standing, and—most importantly—transferable to the new entity post-acquisition.

- Review All Litigation: Examine all pending, threatened, and past litigation. Pay close attention to the nature of the claims and any potential for future similar lawsuits.

- Assess Regulatory Adherence: Investigate compliance with industry-specific regulations like HIPAA or SOX. For data-driven businesses, confirming adherence to privacy laws like GDPR and CCPA is non-negotiable. Learn more from our guide on cybersecurity compliance services.

- Conduct Sanctions Screening: Perform a thorough sanctions screening of the target company, its key personnel, and major customers to avoid inheriting geopolitical risks.

3. Operational Due Diligence: Can the Business Actually Scale?

Operational due diligence investigates the engine room of the target company. It moves past financial figures to assess how the business actually creates value. This crucial step examines everything from supply chain resilience to technology infrastructure. It’s about understanding if the company’s day-to-day functions are efficient, scalable, and capable of supporting future growth.

A comprehensive operational review as part of your due diligence checklist for acquisition uncovers hidden risks. For example, you might discover an over-dependence on a single supplier in a volatile region. Conversely, you could find underutilized assets or inefficient processes that represent quick wins for post-acquisition improvement.

Why It’s a Critical Next Step

A profitable company can still be a nightmare to integrate if its operations are a tangled mess. Failing to vet the operational core can lead to unexpected capital expenditures and service disruptions that alienate customers. Imagine acquiring a fast-growing e-commerce brand only to discover its warehouse management system is obsolete and cannot handle the forecasted order volume, requiring a costly, unbudgeted replacement.

Actionable Tips for Operational Diligence

- Conduct On-Site Tours: There is no substitute for walking the factory floor or sitting with the customer support team. Seeing operations firsthand provides insights that documents alone cannot.

- Interview Key Operational Staff: Speak directly with plant managers, supply chain directors, and IT leaders. They understand the real-world bottlenecks and systemic weaknesses.

- Map Core Business Processes: Document key workflows like order-to-cash. This exercise helps identify inefficiencies and areas ripe for automation.

- Assess Technology and Systems: Evaluate whether the core technology (ERP, CRM) is modern, scalable, and secure. Obsolete systems are a major integration headache.

- Analyze Supplier and Vendor Contracts: Review key supplier agreements for unfavorable terms, concentration risk, and change-of-control clauses that could be triggered by the acquisition.

4. Commercial Due Diligence: Is Revenue Built to Last?

While financials tell you what a company has earned, commercial due diligence tells you how it earned it and whether it can continue to do so. This process evaluates the target’s position in the market and the stability of its customer base. It’s about stress-testing the business model to ensure its commercial foundation is solid.

A comprehensive commercial review within your due diligence checklist for acquisition means digging into customer contracts and analyzing revenue concentration. This is where you might discover that 60% of the target’s revenue comes from a single client whose contract is up for renewal next month, or that an aggressive new competitor is eroding their market share.

Why It’s a Critical Pillar of Diligence

Neglecting this area means you are flying blind on future revenue. An acquirer could close a deal only to face a mass customer exodus triggered by change-of-control clauses they failed to identify. For example, a tech firm might acquire a SaaS company based on its high Annual Recurring Revenue (ARR), only to discover its largest customers had termination-for-convenience clauses and were already evaluating alternatives.

Actionable Tips for Commercial and Customer Diligence

- Analyze Customer Concentration: Identify the top 10-20 customers and determine the percentage of total revenue they represent. High concentration is a significant risk.

- Scrutinize Key Contracts: Thoroughly review major customer contracts. Look for change-of-control clauses, renewal terms, and pricing structures that pose a risk post-acquisition.

- Conduct Customer Reference Calls: Speak directly with key customers. Go beyond simple satisfaction questions to understand their purchasing drivers and loyalty.

- Map the Competitive Landscape: Identify competitors, analyze their strengths, and assess the target’s unique value proposition. Is their market position sustainable?

- Verify Churn and Retention Rates: Don’t just accept the company’s stated churn rate. Independently calculate it based on raw data and understand the reasons behind customer departures.

5. Human Resources Due Diligence: Are We Buying Talent or Trouble?

An acquisition isn’t just about assets; it’s about acquiring a team, its culture, and its liabilities. Human Resources (HR) due diligence investigates the people-side of the business, from leadership and key talent to compliance and cultural dynamics. This process uncovers hidden costs, like underfunded pension plans, and assesses the risk of losing the very people who create the company’s value.

A comprehensive HR review as part of your due diligence checklist for acquisition examines employment contracts, compensation structures, and labor law compliance. It’s here you might discover that the sales team operates without non-compete agreements, or that the company has a history of unresolved employee complaints, creating significant legal exposure.

Why It’s a Critical Step

Overlooking HR diligence can lead to a disastrous cultural clash or an exodus of key talent. An acquirer could find themselves responsible for millions in misclassified employee wages. For example, a tech firm might acquire a smaller company for its star engineering team, only to find they have no long-term incentives and are all planning to leave after their options vest, gutting the deal’s primary value.

Actionable Tips for HR Diligence

- Request a Full Employee Census: Obtain a detailed, anonymous list of all employees with their title, tenure, location, and compensation. This provides a clear picture of the organizational structure.

- Analyze Key Person Risk: Identify essential employees whose departure would significantly harm the business. Review their contracts and retention incentives, and conduct confidential interviews if possible.

- Audit Employment Practices: Scrutinize compliance with all relevant labor laws, including wage-and-hour regulations and employee classifications.

- Evaluate Benefits and Liabilities: Review all employee benefit plans, including health insurance and retirement plans. Engage an actuary to assess any underfunded liabilities.

- Assess Cultural Compatibility: Look at employee engagement surveys, turnover data, and leadership styles to determine how well the target’s culture will integrate with your own.

6. Technology and Data Security Due Diligence: Is the Tech a Ticking Time Bomb?

In today’s economy, a company’s technology stack and data security are as critical as its balance sheet. This part of your due diligence checklist for acquisition is a deep-dive into the target’s infrastructure, software, and cybersecurity practices. It’s about verifying that the technology that powers the business is secure and scalable, not a hidden risk.

A thorough technology review assesses everything from software licensing and open-source code usage to data privacy compliance under regulations like GDPR. The goal is to identify vulnerabilities and understand the true cost of integrating the tech stack. This is where you might uncover that a core product relies on undocumented open-source components with restrictive licenses or that customer data handling creates significant regulatory exposure.

Why It’s a Critical Step

Overlooking technology and security diligence can lead to catastrophic surprises. An acquirer could inherit a system riddled with vulnerabilities, leading to a costly data breach that destroys customer trust. For instance, a buyer might discover after closing that the target company suffered an undisclosed breach, creating a significant legal and reputational liability that devalues the acquisition.

Actionable Tips for Technology and Data Security Diligence

- Engage Cybersecurity Experts: Partner with a specialized firm to conduct penetration testing and vulnerability assessments. Their independent analysis provides an unbiased view of the target’s security posture.

- Audit Data Privacy and Compliance: Review all data privacy policies, data maps, and records of compliance with relevant regulations. Scrutinize the history of security incidents.

- Verify IP and Software Licenses: Conduct a thorough audit of all software licenses, including open-source libraries. Ensure that all intellectual property is properly documented and owned by the company. Our guide on technology and security diligence offers more specific questions.

- Assess IT Infrastructure and Operations: Evaluate the scalability, reliability, and disaster recovery capabilities of the existing infrastructure. Determine if the technology can support your growth plans.

- Benchmark Against Frameworks: Evaluate the target’s security controls against established frameworks like NIST or ISO 27001 to identify gaps and areas for immediate post-close improvement.

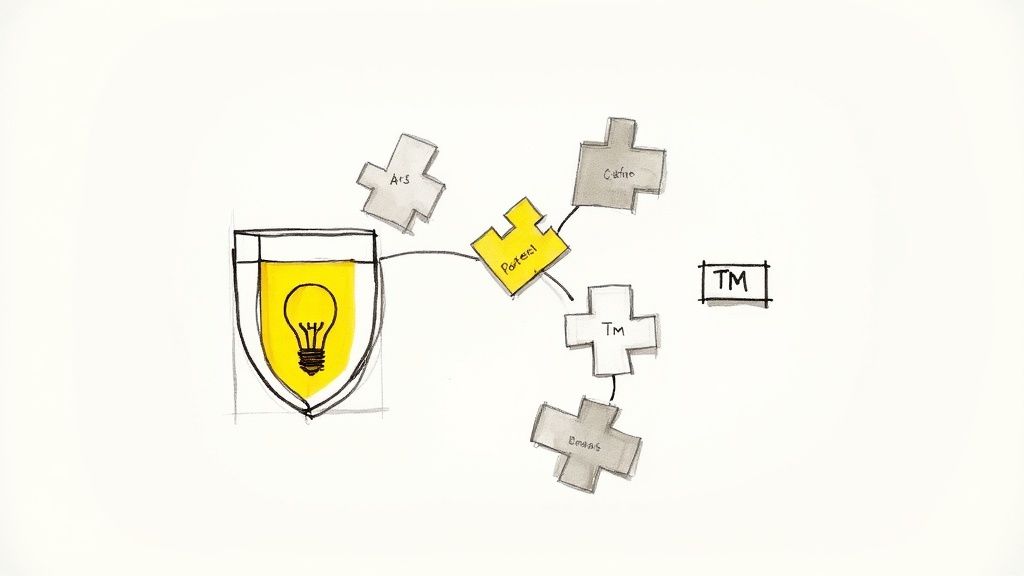

7. Intellectual Property (IP) Due Diligence: Do They Own Their “Secret Sauce”?

Intellectual property (IP) is often the crown jewel of an acquisition, representing the core innovation and competitive advantage you are paying for. IP due diligence is the process of rigorously examining a target’s patents, trademarks, copyrights, and trade secrets. This investigation validates ownership, assesses the strength of the IP, and uncovers hidden risks like infringement claims.

A comprehensive IP review within your due diligence checklist for acquisition confirms that the patents covering the flagship product are legally sound and properly assigned to the company, not a founder. It verifies that key brand names are trademarked in all strategic markets. Failing to do this can mean acquiring a company whose most valuable assets are unenforceable or don’t legally belong to them.

Why It’s a Critical Step

Overlooking IP diligence is like buying a house without checking the deed. An acquirer could close a deal only to discover the core technology infringes on a competitor’s patent, triggering an expensive lawsuit. For example, a tech firm might acquire a software company, later finding out that its key algorithms were built using open-source code with restrictive licenses, forcing a costly rewrite of the entire product.

Actionable Tips for IP Diligence

- Engage IP Specialists: Involve experienced patent and trademark attorneys early. Their knowledge is crucial for conducting freedom-to-operate analyses.

- Verify Ownership and Chain of Title: Meticulously review all assignment documents to confirm the target company has clear ownership of all claimed IP, including that created by founders and contractors.

- Review Patent Portfolios: Analyze the scope and expiration dates of key patents. A portfolio heavily weighted towards patents expiring in the next two years offers a shorter runway for competitive advantage.

- Audit Trademark and Domain Registrations: Confirm that trademarks are registered and in good standing in every jurisdiction where the company operates.

- Assess Trade Secret Protection: Examine policies related to trade secrets, including employee non-disclosure agreements (NDAs) and security measures to ensure proprietary information is protected.

8. Environmental, Health & Safety (EHS) Due Diligence: Are We Buying a Toxic Asset?

Often overlooked in tech or service deals, Environmental, Health & Safety (EHS) due diligence is a critical risk-mitigation step. This process investigates the target’s compliance with environmental regulations and the robustness of its workplace safety programs. It’s about ensuring the company’s assets don’t come with hidden cleanup costs or a legacy of non-compliance.

A thorough EHS review assesses everything from historical land use to current employee safety protocols. You might discover that an office building was built on a former industrial site, creating a risk of soil contamination. Or, an audit could reveal systemic violations of Occupational Safety and Health Administration (OSHA) standards, exposing the company to significant penalties.

Why It’s a Critical Safeguard

Ignoring EHS diligence can lead to catastrophic financial consequences. An acquirer could become responsible for multi-million-dollar environmental remediation projects. For example, a firm acquiring a light manufacturing business might conduct a Phase I environmental assessment and discover a neighboring property’s contamination has migrated, creating a liability that must be addressed before the deal can close.

Actionable Tips for EHS Diligence

- Start with a Phase I Assessment: For any owned real estate, commission a Phase I Environmental Site Assessment (ESA). This is a non-intrusive investigation to identify potential environmental liabilities.

- Review All Permits and Records: Request and scrutinize all environmental permits, compliance reports, and any correspondence with regulatory agencies like the EPA or OSHA.

- Assess Safety Programs: Evaluate the target’s health and safety policies and incident reports. A high rate of workplace accidents is a major red flag.

- Quantify Potential Liabilities: If issues are identified, engage environmental consultants to estimate potential remediation costs or fines. This allows you to negotiate a price reduction.

- Check Insurance Coverage: Review the target’s environmental and general liability insurance policies to understand the extent of coverage for EHS-related claims.

9. Tax Due Diligence: Is There an Unpaid Bill Waiting for Us?

Tax due diligence is a critical examination of a target company’s tax history and potential future liabilities. It’s an in-depth analysis to uncover hidden risks and confirm compliance with complex tax laws. This process ensures no unexpected tax bills will surface after the deal is closed.

A comprehensive tax review is a core component of any serious due diligence checklist for acquisition. It involves scrutinizing income tax, sales and use tax, and payroll tax compliance. An acquirer might discover the target has been incorrectly classifying workers as independent contractors, creating a significant payroll tax liability, or that its transfer pricing policies could trigger major penalties.

Why It’s a Critical Step

Overlooking tax diligence can lead to catastrophic financial consequences. An acquirer could inherit substantial unpaid tax liabilities that directly impact the company’s cash flow. Imagine acquiring a SaaS company only to discover it failed to collect and remit sales tax in dozens of states where it had economic nexus, leaving you with a multi-million dollar liability. Proper tax diligence quantifies these exposures so they can be addressed in the purchase agreement.

Actionable Tips for Tax Diligence

- Engage Tax Specialists Early: Involve experienced M&A tax advisors. Their expertise is essential for navigating the complexities of state, federal, and international tax law.

- Review All Historical Tax Returns: Request and thoroughly analyze at least three to five years of all filed tax returns for accuracy and aggressive positions.

- Assess Audit Risk: Examine the target’s tax positions and strategies. Review any history of tax audits and their outcomes to understand the company’s risk profile.

- Evaluate Transfer Pricing: For companies with international operations, scrutinize intercompany transactions and transfer pricing policies to ensure they are compliant.

- Identify Tax Attributes: Analyze available net operating losses (NOLs) and R&D tax credits. Determine if they will survive the acquisition and can be utilized post-close.

10. Insurance and Risk Management Due Diligence: Are We Covered for What Might Go Wrong?

Insurance and risk management due diligence involves a detailed examination of a target company’s insurance coverage and claims history. This assessment identifies potential coverage gaps, uninsured liabilities, and historical loss patterns that could introduce significant post-acquisition costs. It ensures the company is not just insured, but correctly and adequately insured.

A comprehensive review of insurance as part of your due diligence checklist for acquisition will scrutinize general liability, property insurance, and specialized policies like Directors & Officers (D&O) and cyber liability. This is where you might discover that a key facility is underinsured against fire damage or that the existing cyber policy has a critical exclusion for the most likely type of data breach.

Why It’s a Critical Step

Overlooking this area can expose an acquirer to catastrophic financial losses. An acquirer could inherit a history of frequent workers’ compensation claims that lead to a massive premium increase upon renewal. For example, a buyer might find that the target’s D&O insurance is insufficient for the new, larger entity, leaving new leadership personally exposed in a lawsuit.

Actionable Tips for Insurance and Risk Diligence

- Engage Insurance Experts: Involve your company’s insurance broker or a specialized risk consultant early. They can analyze policies for exclusions and insufficient limits.

- Analyze Claims History: Request a multi-year loss run report for all major policies. Scrutinize this data for recurring claims or trends that suggest underlying operational issues.

- Review All Current Policies: Obtain and thoroughly review copies of all active insurance policies. Pay close attention to policy limits, deductibles, and specific exclusions.

- Assess Post-Close Coverage Continuity: Determine if the target’s policies will remain in effect post-acquisition. Plan for obtaining necessary new coverage to avoid any gaps.

- Evaluate “Tail” or “Run-Off” Needs: For claims-made policies like D&O, verify that adequate extended reporting period (tail) coverage is in place to cover pre-closing acts.

10-Point Acquisition Due Diligence Checklist Comparison

| Due Diligence Type | Implementation complexity | Resource requirements | Expected outcomes | Ideal use cases | Key advantages |

|---|---|---|---|---|---|

| Financial Due Diligence | High — deep accounting and forensic review | Senior accountants, auditors, financial models, historical statements | Validated valuation; identified hidden liabilities; cash flow clarity | Price validation, valuations, distressed targets | Confirms price, uncovers financial risks, enables adjustments |

| Legal and Regulatory Compliance | High — multi-jurisdiction legal analysis | External counsel, compliance specialists, document review | Legal risk profile; license/permit issues; litigation exposure | Regulated industries, cross-border deals, public company targets | Prevents legal surprises; protects acquirer from liabilities |

| Operational Due Diligence | Medium–High — site visits and process reviews | Ops consultants, engineers, on-site inspections, IT assessors | Operational bottlenecks; scalability and integration gaps | Manufacturing, supply-chain dependent businesses, operations-heavy deals | Identifies synergies, cost savings, integration challenges |

| Commercial and Customer Due Diligence | Medium — market and customer analysis | Market research, CRM access, commercial analysts | Revenue quality validation; customer concentration risk; market position | Revenue-driven valuations, SaaS/B2B, high client-concentration targets | Validates revenue sustainability and market opportunities |

| Human Resources & Employment Due Diligence | Medium — workforce and benefits review | HR consultants, employment lawyers, actuaries | Workforce liabilities; retention risk; benefit obligations | Talent-dependent firms, unionized workplaces, companies with complex benefits | Quantifies labor risks; identifies key-person exposure; ensures compliance |

| Technology & Data Security Due Diligence | High — technical and security assessments | Cybersecurity firms, IT auditors, code/IP reviewers | Cyber vulnerabilities; data privacy gaps; system integrity | Software, data-intensive firms, IoT and SaaS businesses | Detects security risks; verifies data/privacy compliance and IP |

| Intellectual Property Due Diligence | High — patent/trademark analysis | Patent attorneys, IP search firms, licensing experts | IP ownership validation; infringement and FTO risks | Tech, pharma, R&D-heavy companies, IP-driven valuations | Validates core IP assets and defensibility; informs deal value |

| Environmental & Health & Safety Due Diligence | Medium–High — site and compliance testing | Environmental consultants, Phase I/II investigators | Environmental liabilities; remediation costs; safety compliance | Real estate, manufacturing, chemical and heavy industries | Identifies contamination and regulatory exposures; estimates remediation |

| Tax Due Diligence | High — tax position and structuring review | Tax advisors, transfer pricing experts, accountants | Hidden tax liabilities; audit risk; optimal tax structure | Cross-border M&A, complex tax profiles, transfer-pricing exposure | Reveals tax exposure; identifies credits and structure efficiencies |

| Insurance & Risk Management Due Diligence | Medium — policy and claims analysis | Insurance brokers, risk analysts, claims reviewers | Coverage adequacy; claims trends; uninsured liabilities | Asset-heavy firms, high-liability businesses, regulated sectors | Identifies coverage gaps; informs risk transfer and insurance needs |

From Checklist to Confidence: Your Next Step

Moving through this due diligence checklist for acquisition transforms uncertainty into actionable intelligence. Each piece reveals a part of the story, highlighting not just the immediate value but also the hidden risks and latent opportunities that will define your post-close reality.

Many leaders approach due diligence as a defensive hunt for deal-breakers. While that’s part of it, its true power lies in its offensive capability. The findings from this process are the raw materials for a successful integration roadmap. You move from discovering problems after the deal is signed to having a clear, prioritized plan to address them from day one.

The Stakes are High

If you do nothing and rely on a surface-level review, you risk inheriting a business full of hidden liabilities. You could spend years unwinding technical debt, fighting unforeseen lawsuits, or trying to retain key talent that walks out the door. The strategic acquisition that was meant to accelerate growth becomes an expensive anchor dragging your company down.

But if you follow this plan, the outcome is clarity. You go to the negotiating table armed with data, not just assumptions. You build a post-merger integration plan that works because it’s based on reality. You protect your investment and position the newly combined company for the success you envisioned from the start.

The goal of due diligence is not to find a perfect company. The goal is to understand the company you are actually buying, with all its strengths and flaws, so you can pay a fair price and build a realistic plan for creating value.

Ultimately, this rigorous process is about de-risking your investment and accelerating your path to the strategic goals that prompted the acquisition in the first place. You replace anxiety about the unknown with a clear-eyed understanding of the challenges ahead. You’re not just buying a company; you are buying its future potential, and this checklist is your map to unlocking it.

An acquisition is one of the highest-stakes decisions a leader can make, and you don’t have to navigate the technical complexities alone. At CTO Input, we act as your on-demand technology and security leadership, translating complex technical risks into clear business implications for your deal team. If you need an experienced guide to help you uncover the hidden risks and opportunities in your next acquisition, schedule a discovery call with us today.