The deal looks perfect. The numbers add up, the market opportunity is obvious, and your team is ready to sign. But what if the technology at the heart of that multi-million dollar acquisition is a ticking time bomb?

This is the central fear that technology due diligence is designed to eliminate. Think of it as a master mechanic inspecting a classic car before you buy it—going far beyond the shiny paint to make sure the engine, transmission, and frame are sound. It’s about verifying that the software, infrastructure, and team can actually deliver on the promises made in the pitch deck.

The Hidden Risk in Your Next Big Deal

Picture this: you’ve just closed a major acquisition. The press release is getting great traction, and the board is thrilled. But a few weeks in, things start to unravel. The acquired company’s platform is constantly crashing, infuriating your newly combined customer base. Your engineers discover the entire system was held together by one key developer who just resigned, taking all the critical knowledge with them.

Suddenly, that celebrated deal has become an operational nightmare. Instead of driving growth, you and your leadership team are trapped in emergency meetings, trying to solve one technical crisis after another. This isn’t a hypothetical; it’s the all-too-common reality for leaders who mistake a simple IT check for genuine technology due diligence.

From Checkbox to Strategic Insight

Too often, executives treat diligence as a technical to-do list for the IT department. This is a massive mistake. Real technology due diligence is a business risk assessment that connects technical findings directly to financial and operational outcomes.

It’s not just about asking if the code works. It’s about asking the right business questions:

- Scalability: Can this platform actually support the aggressive growth we’re forecasting, or will it buckle under the pressure?

- Security: Are we inheriting a massive security hole that could lead to a devastating data breach and crippling fines? Understanding this is vital for managing your third-party cyber risk before you connect any systems.

- Integration: What is the actual cost—in time and money—to merge this technology with our own stack?

- Team: Does their engineering team have the talent and processes to build what’s next, or are we acquiring a skills gap we’ll have to fix?

A proper diligence process stops validating what you’ve been told and starts uncovering what you need to know. It’s about protecting your investment by finding the truth before the ink is dry.

Skipping this deep dive is a high-stakes gamble. The risk isn’t just a buggy app; it’s a failed acquisition, a wasted investment, and a serious blow to your company’s reputation. The goal is to walk into the deal with your eyes wide open, fully aware of the asset you’re truly buying.

When is Tech Diligence a Must-Have?

Most leaders hear “due diligence” and picture a blockbuster corporate takeover. But in reality, a deep-dive technical review is essential anytime you’re making a strategic bet on technology you don’t own or fully understand. Think of it as a critical risk management step for the make-or-break moments in your company’s journey.

Knowing when you’ve hit one of those moments is half the battle. These are the inflection points where a hidden technical flaw could completely derail the business case for your decision. A quick once-over just won’t do when the stakes are this high.

Mergers and Acquisitions (M&A)

This is the classic use case, and for good reason. When you buy a company, you’re also buying its entire technology stack—the good, the bad, and the ugly. A proper diligence process here isn’t about ticking boxes; it’s about putting a dollar figure on the problems you find.

You’re trying to answer tough, practical questions:

- What is the real cost to merge their systems with ours?

- Is their platform actually built to handle the growth we’re projecting?

- Are we about to inherit a massive security hole or a compliance nightmare that becomes our problem on day one?

Skip this step, and you could be looking at surprise integration costs that soar into the millions. Even worse, you could face operational chaos that completely erodes the value you thought you were acquiring.

In an M&A deal, technology due diligence is your insurance policy against buying a lemon. It gives you the ammunition to negotiate a fair price based on what the technology is actually worth, not just the sales pitch.

Investor Due Diligence

Whether you’re a VC evaluating a startup or a founder getting ready to raise a round, tech diligence is front and center. For investors, it’s about separating fact from fiction. Does the product actually work as advertised? More importantly, can the architecture handle the explosive growth your capital is meant to ignite?

For founders, being ready for this level of inspection shows you’re serious. It demonstrates a deep understanding of your tech’s strengths and weaknesses and proves you have a credible plan to improve. A well-architected, secure, and scalable platform doesn’t just protect your valuation; it builds investor confidence, shifting the conversation from “Can you do this?” to “How big can this get?”

Strategic Vendor Selection

The same logic applies when choosing a critical technology partner, like a new ERP or CRM platform. This is a decision that will shape your operations for the next 5 to 10 years. Getting it wrong can lead to a decade of headaches, lost productivity, and wasted money as your team tries to force a system to do something it was never designed for.

Diligence for a major vendor means putting their claims to the test. Can their system actually support your unique workflows? How robust is their security? Does their product roadmap line up with where your business is headed? It’s not about a feature list; it’s about ensuring a vendor’s technology—and their team—can truly grow with you.

As global M&A deal volume has climbed by 12% year-on-year, the need for smarter diligence has grown with it. We’re seeing more AI and automation used to sift through risks, especially around cybersecurity and compliance with frameworks like SOC 2. To get a better sense of how these strategies are changing, you can find more insights on the evolution of due diligence at Magistral Consulting.

A Practical Framework for Technical Diligence

Trying to get your arms around a company’s entire technology stack can feel like trying to boil the ocean. To make the technology due diligence process manageable, you need a straightforward framework—a simple plan a non-technical leader can understand and champion. The goal isn’t to become a software expert overnight; it’s to ask the right business questions and know what the answers actually mean.

This five-phase framework is designed to cut through the noise and zero in on what truly matters to your investment. It transforms a chaotic technical deep dive into a structured, business-focused review.

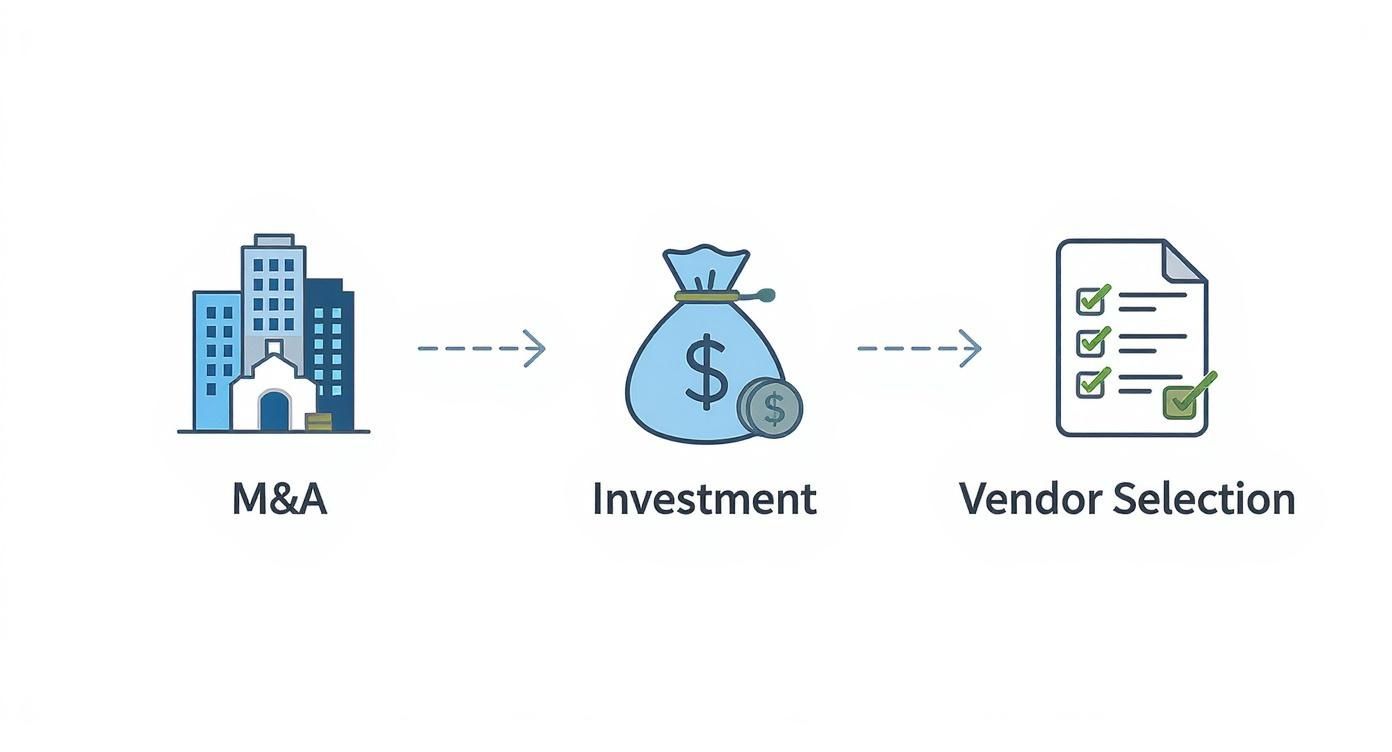

This flow chart shows how diligence fits into critical business scenarios, whether you’re acquiring a company, seeking investment, or selecting a key vendor.

As you can see, each of these strategic moves hinges on the same core principle: verifying that the underlying technology can deliver the business outcome you expect.

Phase 1: Define the Business Context

Before anyone looks at a single line of code, you have to define the why. What specific decision will this diligence inform? Are you trying to validate an acquisition price? Assess if a vendor can scale with you? Or confirm a startup’s bold product claims before wiring the investment?

The business context is everything. It sets the scope for the entire review. Without it, your technical team is flying blind, and their report will just be a collection of technical trivia instead of a powerful decision-making tool.

The most important question to answer upfront is: “What specific business decision will we make based on these findings?” This one question aligns everyone on what success looks like.

Phase 2: Review the Documentation

Next, it’s time to look at the paper trail. This means digging into architecture diagrams, security policies, disaster recovery plans, and documents outlining the software development process. Think of it as reviewing the building’s blueprints and maintenance logs before you inspect the foundation.

What you’re looking for here isn’t perfection, but clarity and maturity. A company with well-organized, up-to-date documentation is almost always more disciplined in its engineering practices. A complete lack of documentation is a huge red flag—it often signals chaos and a dangerous reliance on just a few key people.

Phase 3: Assess the Team and Processes

Technology is built and maintained by people. A brilliant platform with a burnt-out, under-skilled, or departing team is a rapidly depreciating asset. This phase involves interviewing key technical leaders and engineers to get a real feel for their capabilities, processes, and morale.

You need to answer a few key questions:

- Do they have the skills to execute the future roadmap?

- What is their process for shipping quality code reliably?

- Is there a high level of key-person dependency, where one person leaving could bring everything to a grinding halt?

Remember, a strong team can fix a weak product, but even the best product will eventually crumble under a dysfunctional team.

Phase 4: Analyze the Architecture

Now we get under the hood. This is where a technical expert evaluates the core systems for scalability, security, and quality. A big part of this is assessing the level of technical debt—the implied cost of rework caused by choosing an easy, short-term solution instead of the right one.

This isn’t about nitpicking code. It’s about answering big, strategic questions. Is the foundation solid enough to build on, or is it brittle and likely to crack under the pressure of growth? Are there glaring security holes that would expose your business to an unacceptable level of risk?

Phase 5: Report on Business Impact

Finally, and most critically, all technical findings must be translated back into business terms. A report that just lists security vulnerabilities or outdated software versions is useless to a CEO or CFO.

A good diligence report connects every finding to a potential business outcome. It turns technical jargon into tangible risk and cost.

For example:

- “The lack of automated testing means new feature releases will be slow and risky, delaying our time-to-market by 3-6 months.”

- “Their outdated server infrastructure can’t handle projected user growth, which will require an immediate, unbudgeted capital expenditure of $250,000 to avoid system crashes.”

This final step is what makes technology due diligence a strategic weapon, not just a technical checklist. It gives you the clear, actionable insights needed to negotiate better terms, plan for integration, or confidently walk away from a bad deal.

Uncovering the Most Expensive Red Flags

Not all tech problems are created equal. Some are minor headaches. Others are ticking time bombs, buried deep in a company’s architecture, just waiting to blow up a deal or cripple your operations. A proper technology due diligence process is all about finding those bombs before they go off.

This is arguably one of the most vital parts of any major transaction. A recent M&A study found that a staggering 45% of respondents called technology due diligence the most expensive and time-consuming part of the whole process. And with security risks on the rise, 97% of dealmakers report putting a company’s cybersecurity under a much stronger microscope. You can dig into these trends in the full M&A due diligence study from SRS Acquiom.

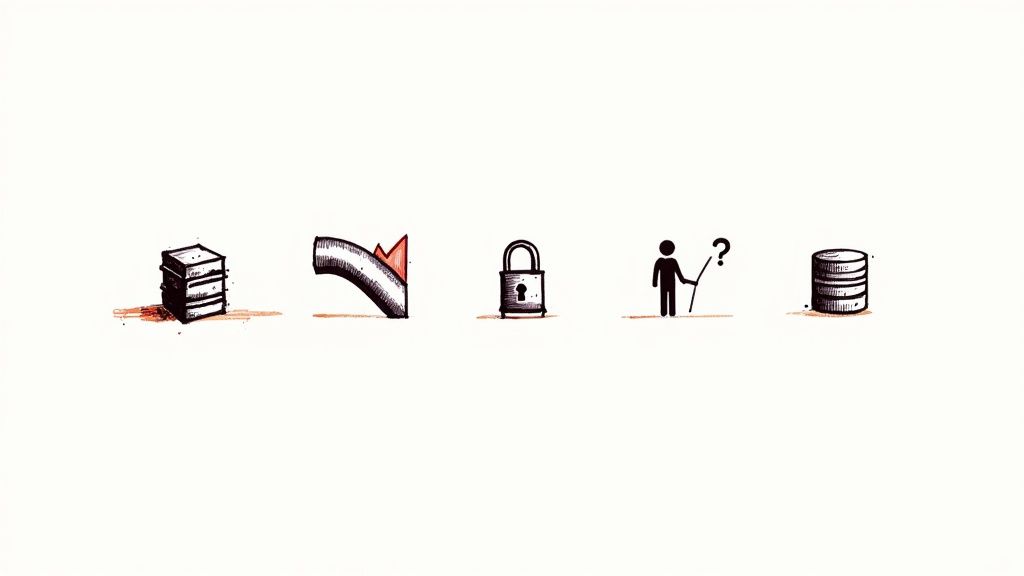

These are the five costliest red flags your diligence needs to find—the ones that can turn a golden opportunity into a money pit.

Crippling Technical Debt

Think of it like buying a house that looks great on the surface, but the previous owner cut corners on every single repair. The plumbing is a mess, the wiring is a fire hazard, and the foundation has cracks they just painted over. That’s technical debt. It’s the sum of every shortcut, every “we’ll fix it later” decision, and every time speed was chosen over quality.

A little bit of debt is normal. But a mountain of it is a deal-killer. It means every new feature you try to build will take twice as long and be three times as likely to break something else. This debt becomes a silent tax on your engineering budget, forcing you to spend money just to keep the lights on instead of innovating.

A Weak Cybersecurity Posture

This is the unlocked back door you never knew existed. A company with a poor security setup is a sitting duck for hackers. We’re not just talking about having a firewall; this is about a deep, company-wide culture of security.

Has the company had data breaches they never disclosed? Are they patching their systems regularly? Is sensitive customer data actually encrypted? When you acquire a company with lax security, you’re inheriting a massive, unquantifiable liability. The cost of just one major breach—in fines, legal battles, and lost customer trust—can easily dwarf the value of your entire investment.

A Lack of True Scalability

The pitch deck promises hockey-stick growth. The diligence process has to ask the hard question: can the tech really handle it? It’s one thing to build a platform that works perfectly for a few hundred users; it’s another thing entirely for it to not collapse under the weight of thousands.

This isn’t a hypothetical issue. A system that can’t scale puts a hard ceiling on your revenue potential. The moment your big marketing campaign goes viral and new customers start pouring in, the platform crashes. You’ve not only lost those sales but also severely damaged your brand’s reputation. Trying to fix scalability problems after the fact is always a far more expensive and painful process.

A platform that can’t scale isn’t an asset; it’s a bottleneck. It puts a hard limit on your company’s growth potential, no matter how good your sales and marketing teams are.

Critical Key-Person Dependencies

In so many companies, there’s that one engineer—let’s call her Sarah—who is the only person who truly understands how a critical piece of the system works. She built it, she maintains it, and the documentation for it lives entirely inside her head. Sarah is an incredible asset, but she’s also a single point of failure.

This is a key-person dependency. What happens if Sarah wins the lottery and quits tomorrow? That part of your system grinds to a halt. Nobody else knows how to fix it, let alone improve it. Good diligence is about identifying these dependencies and figuring out just how much risk they pose to the business if that key person walks out the door.

Poor Data Governance and Compliance

Last but not least, you have the compliance nightmare just waiting to happen. In a world governed by GDPR, CCPA, and an alphabet soup of other regulations, how a company handles its data isn’t just an IT problem—it’s a fundamental business risk.

Poor data governance means nobody’s really sure where customer data is, who can access it, or if it’s being used legally. This can lead to eye-watering fines and operational chaos. Getting this right is crucial for maintaining trust. Our guide on IT compliance services dives deeper into what a solid framework looks like. Ignoring this red flag is betting your business that regulators will never come knocking.

Turning Diligence Findings Into an Action Plan

A thick technology due diligence report just landed on your desk, packed with technical jargon and a laundry list of problems. Now what? A report that only points out what’s broken is a recipe for anxiety. The real value of diligence is turning those findings into a clear, prioritized action plan.

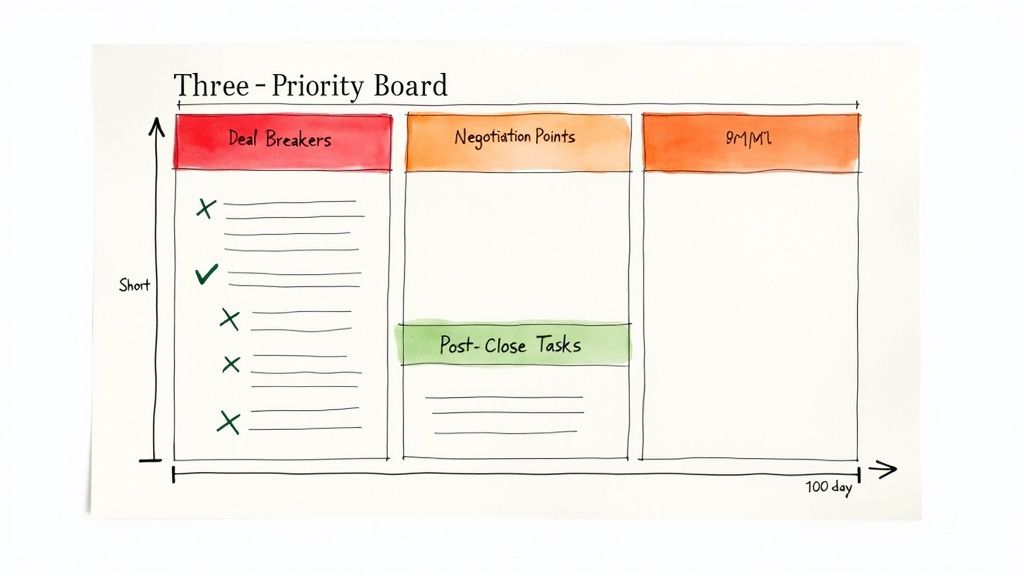

This is where abstract risks become concrete business decisions. A seasoned expert won’t just dump problems in your lap; they’ll help you sort every single finding into one of three buckets, lighting up the path forward.

Categorizing Risks for Decisive Action

Your first move is triage. Not all red flags are created equal. By sorting the issues by severity, you can confidently decide whether to move forward, renegotiate the terms, or walk away from the table entirely.

-

Deal-Breakers: These are the showstoppers. We’re talking about catastrophic issues like an undisclosed data breach, a core product built on stolen code, or a system so fundamentally flawed it can’t serve current customers, let alone scale. Discoveries this big often justify killing the deal.

-

Negotiation Points: These are problems that are serious but solvable—and they come with a price tag. Think significant technical debt that will cost $500,000 and six months to resolve, or an urgent and expensive migration off failing server infrastructure. These findings give you powerful leverage to go back and renegotiate the valuation.

-

Post-Close Integration Tasks: This bucket is for the manageable risks you’re willing to own and fix after the deal closes. It might include a chaotic development process that needs structure or a few non-critical security vulnerabilities. You accept these issues, but with a clear-eyed plan and budget to tackle them from day one.

The goal isn’t to find a perfect company with zero technical flaws—that company doesn’t exist. The goal is to walk into a deal with your eyes wide open, fully understanding the costs and effort required to get the technology where it needs to be.

Building the 100-Day Remediation Plan

Once you’ve made the call to proceed, the next step is to create a practical 100-day plan. This isn’t a vague wish list. It’s a focused roadmap designed to address the most critical issues first, stabilize the asset, and protect your investment.

This plan should organize fixes based on two simple factors: business impact and level of effort. A high-impact, low-effort fix—like patching a glaring security hole—jumps to the top of the list. A low-impact, high-effort project can wait. This approach creates immediate momentum and ensures your team is spending their energy where it matters most.

New tech investments are changing how this work gets done. With 37.4% of organizations already using generative AI and another 33.8% planning to, these tools are speeding up the risk assessment phase. According to insights on how AI is changing diligence practices at Binmile, this allows leaders to put more focus on strategic fixes, like clearing out the technical debt that’s been dragging down efficiency for years.

Building this plan transforms chaos into focused execution. If your team feels like they’re always putting out fires, our guide on how to turn IT firefighting into a 12-month technology roadmap provides a structured way to get back in control. An experienced fractional CTO can work alongside you to build this roadmap, making sure the technology is ready to drive your business goals from the moment the deal is done.

The High Stakes of Getting This Wrong

Skipping proper technology due diligence isn’t just cutting a corner; it’s buying a house without an inspection. From the outside, it might look perfect, but you have no idea if the foundation is cracked or the wiring is a fire hazard. The cost of this gamble isn’t just a number on a balance sheet—it’s a story of profound business failure that unfolds in real-time.

Think about the M&A deal that looked like a sure win. Six months post-acquisition, the celebrated new platform—a brittle house of cards—buckles under the slightest customer load. Projected revenue vanishes, and your best engineers burn out trying to patch a system that was fundamentally broken from the start.

The Two Outcomes

Or consider the high-flying startup that hits a wall. After a huge funding round meant for scaling, they discover their core product is built on a foundation that can’t support growth. The investment that was supposed to fuel expansion gets torched on a desperate, year-long rebuild, while nimble competitors capture the market they were meant to own.

These aren’t just hypotheticals. They are the predictable consequences of treating diligence as an afterthought. We’re talking about years of lost momentum, millions in wasted capital, and the kind of shattered team morale that’s almost impossible to repair.

Let’s be clear: doing nothing is a choice. It’s a bet that critical technical flaws won’t blow up at the worst possible moment. It’s a bet you’ll almost certainly lose.

But there’s a much smarter way forward.

Imagine walking into a negotiation armed with a complete, unbiased picture of the technology you’re about to acquire or invest in. You know its strengths, weaknesses, and exactly what it will cost to integrate, secure, and scale. You can negotiate a better valuation based on cold, hard data, not just optimistic slide decks.

That’s what success looks like. It’s a leader using diligence not as a bureaucratic checkbox, but as a strategic weapon to build a resilient company on a solid technical foundation. You move forward with conviction, knowing your technology won’t just support your growth—it will drive it.

Ultimately, the path you choose determines whether technology becomes your biggest liability or your greatest asset. Getting an objective, expert perspective is the first step toward making sure your next big move is the right one.

Frequently Asked Questions

Even with a solid game plan, you’re bound to have questions when a major decision is on the line. Here are some straight answers to the things leaders ask most about technology due diligence.

How Long Does Technology Due Diligence Take?

For a mid-market company, a typical engagement runs anywhere from two to six weeks. The timeline depends on how complex the tech is, the size of the engineering team, and how cooperative the target company is with providing information. A quick, high-level review might only take a week or two. But if you need a true deep dive—into the source code, cloud infrastructure, and security of a complex software platform—you’re looking at a month or more to do it right. The skill is in balancing speed with depth, ensuring you spend the most energy on the areas that could actually impact the business.

What Is the Difference Between IT and Tech Diligence?

It’s the difference between checking a building’s plumbing and inspecting its architectural blueprints.

-

IT Due Diligence is about operational infrastructure. It looks at the hardware, help desk tickets, employee laptops, and software licenses—the tools the business uses every day. It answers the question: “How does the company keep the lights on?”

-

Technology Due Diligence goes straight to the core intellectual property—the product itself. It digs into the software architecture, code quality, scalability, security, and the team’s development habits. It answers a much more critical question: “Is the asset we’re buying valuable, stable, and ready for what’s next?”

For any company where technology is the product, tech diligence isn’t just important; it’s everything. It’s an evaluation of the engine that drives the business.

Who Should Be Involved in the Diligence Process?

The process needs to be led by a seasoned, objective technical expert—like a fractional CTO or a specialized advisor. You need a leader who is fluent in translating technical jargon into tangible business risk, so the final report actually makes sense to you. On the target company’s side, their CTO or Head of Engineering is your main point of contact. For your team, the deal lead, CEO, and CFO absolutely must be in the room to review the final business-level report. They need to grasp the financial and strategic fallout of what’s discovered.

The best diligence teams are small, focused, and led by an outside expert who can ask the tough questions without getting tangled up in internal politics or existing relationships.

Can We Perform This Diligence Ourselves?

Even if you have a fantastic internal tech team, bringing in an independent, third-party expert is almost always the right move for technology due diligence. Why? An external guide brings an unbiased perspective. They have no emotional investment in the project and aren’t swayed by internal pressures. Plus, they’ve seen this movie before. After dozens of similar assessments, they’ve developed a sixth sense for where skeletons are buried. That kind of objectivity is crucial for making a clear-headed decision and lends a layer of credibility that investors, boards, and lenders expect to see before they sign off on a major deal.

Your next big move—whether it’s an acquisition, a funding round, or a major partnership—is too important to leave to chance. Don’t let a hidden technical flaw derail your strategy. At CTO Input, we translate technical complexity into clear business decisions, giving you the confidence to act.

If you’re facing a strategic decision and need to understand the real story behind the technology, schedule a confidential, no-obligation call with us today. Gain the clarity you need to move forward at ctoinput.com.